Expense Management

Best Receipt Inbox Solution to Minimize Employee Chasing

Minimize Employee Chasing with a Better Receipt Inbox Solution. Float is putting an end to missing receipts and massive submissions at month-end.

August 3, 2022

Are you a Canadian business owner tired of chasing employees for missing receipts over email, slack, or tools like HubDoc or Dext? Do you dread the month-end scramble to reconcile expenses? You’re not alone. Let’s explore Best Receipt Inbox Solution to Minimize Employee Chasing and how it can transform your financial processes and save you valuable time and resources.

The Receipt Compliance Challenge in Canadian Businesses

Receipt compliance is a crucial aspect of financial management for Canadian companies. It ensures that all employees, regardless of their position, meet the receipt requirements set by finance teams. However, many businesses struggle with:

- Time-consuming receipt collection

- Last-minute submission rushes at month-end

- Incomplete or lost receipts

- Difficulty enforcing expense policies across departments

Are you a Canadian business owner tired of chasing employees for missing receipts? Do you dread the month-end scramble to reconcile expenses? You’re not alone. Let’s explore how modern expense management solutions can transform your financial processes and save you valuable time and resources.

Legacy Receipt Inbox Tools

There are a handful of legacy receipt inbox tools on the market today that many Canadian businesses are still using:

None of these are the perfect solution as they introduce a ton of manual work for the Finance teams and your employees.

The Receipt Compliance Challenge in Canadian Businesses

Receipt compliance is a crucial aspect of financial management for Canadian companies. It ensures that all employees, regardless of their position, meet the receipt requirements set by finance teams. However, many businesses struggle with:

- Time-consuming receipt collection

- Last-minute submission rushes at month-end

- Incomplete or lost receipts

- Difficulty enforcing expense policies across departments

Introducing Float: A Game-Changer for Canadian Expense Management

Float, a Canadian fintech company, offers an innovative solution to these common challenges. Their Expense Policy feature is designed to streamline receipt compliance and simplify expense management for businesses across Canada.

Key Features of Float’s Expense Policy

- Customizable Receipt Requirements: Set specific rules for different expense categories.

- Automatic Card Pausing: Cards can be automatically paused when receipt compliance isn’t met.

- Real-Time Notifications: Employees receive prompts to submit receipts immediately after purchases.

- Multi-Level Approval Policies: Assign multiple approval layers for employee spend requests.

How Float’s Receipt Compliance Works for Canadian Businesses

- Setup Submission Policies: Define transaction information requirements, including receipts and accounting codes.

- Implement Approval Policies: Establish approval workflows tailored to your organization’s structure.

- Assign Policies to Cards: Each card is linked to specific submission and approval policies.

- Automated Receipt Collection: Employees receive links to upload receipts immediately after purchases.

Benefits for Canadian Companies

- Improved Financial Visibility: Real-time insights into company spending.

- Reduced Administrative Burden: No more chasing employees for receipts.

- Enhanced Compliance: Ensure adherence to company expense policies.

- Streamlined Reconciliation: Simplify month-end accounting processes.

- Cost Savings: Reduce the risk of fraudulent or non-compliant expenses.

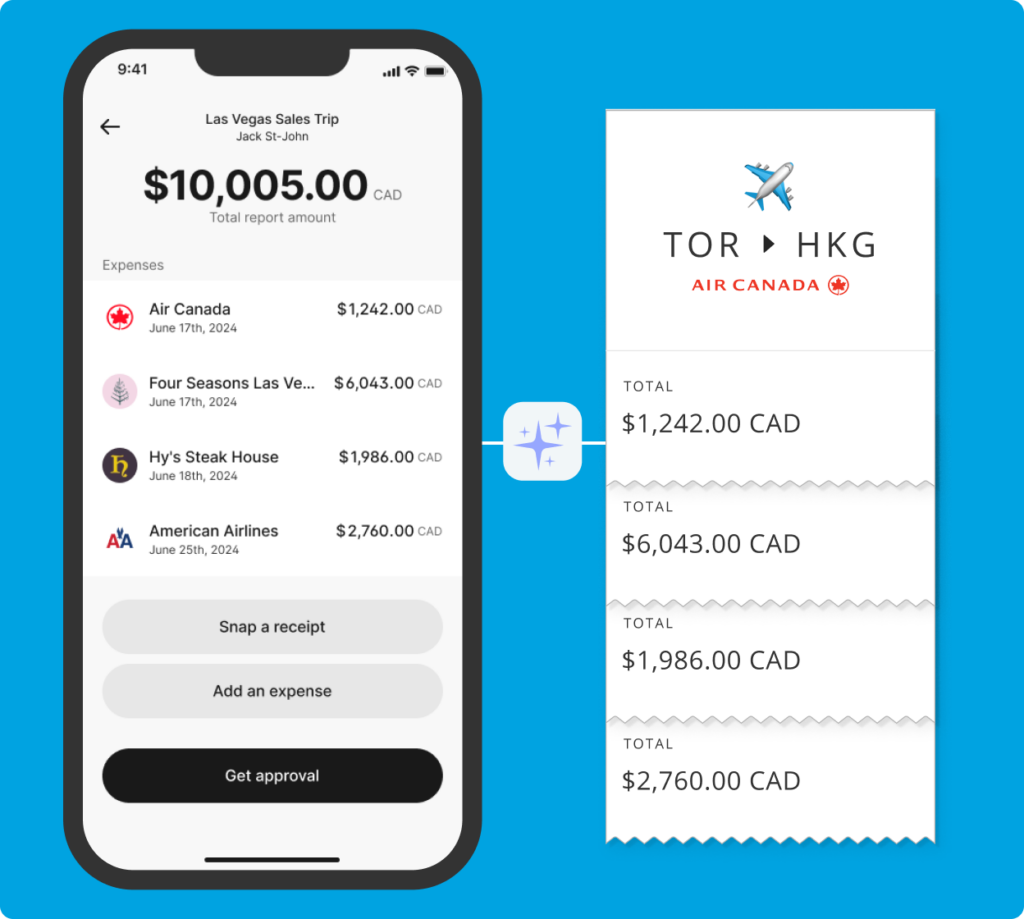

Simple Receipt Submission Process

Float’s user-friendly system makes receipt submission a breeze:

- Employee makes a purchase using a Float card.

- Float sends an automated text or email link.

- Employee uploads the receipt and fills in purchase details.

- Finance team can easily review and categorize the expense.

Why Canadian Businesses Should Consider Float

In today’s fast-paced business environment, Canadian companies need efficient financial management tools. Float’s receipt compliance feature offers:

- Real-time expense tracking

- Simplified accounting and reconciliation

- Reduced risk of lost receipts

- Improved employee accountability

- Time savings for finance teams and employees alike

Conclusion: Elevate Your Expense Management Game

For Canadian businesses looking to streamline their financial processes, Float’s innovative expense management solution offers a powerful answer to the receipt compliance challenge. By implementing this system, you can free up valuable time, improve financial accuracy, and focus on growing your business.

Ready to transform your expense management? Explore how Float can tailor its solutions to meet the unique needs of your Canadian business and drive smarter financial decisions today.

Float is Canada’s only all-in-one corporate cards, reimbursements, and bill pay platform that helps customers:

- Earn cashback on all categories and save on FX

- Generate 4% interest on funds held with Float

- Eliminate expense reports and receipt chasing

- Close the books 5x faster at the month-end

Want to learn how companies like Clutch, Neo, Knix, and 1,000s of other Canadian businesses on average save 7% of their monthly spend with Float? Get started with Float today by clicking the button below!

Want to learn more before singing up? Book a demo today to learn more about the product from our team!

Written by

All the resources

Corporate Cards

Xero Integration for Corporate Cards: Modern Accounting Software Guide

Using Xero becomes more powerful the second you integrate it with your corporate cards. Here's what you need to know.

Read More

Float News

Float 2025: Year in Review

How Float is building the financial system Canadian businesses run on

Read More

Industry Insights

Canada’s Crossroads: Why Now is the Moment to Move from Defensive to Intentional Growth

Float's 2025 report on Canadian business shows modest growth, rising costs and shrinking reserves. Find out exactly what the data

Read More