In the news

5 Best Bench Accounting Alternatives in 2026

Discover how to secure a business credit card with our guide. Boost your financial flexibility and manage expenses effectively with Float!

December 27, 2024

Was your Canadian business impacted by the recent announcement from Bench Accounting about the service shutdown? While services have resumed following Bench’s acquisition, many finance leaders are still exploring alternative solutions due to the uncertainty—and hello, panic—that the initial announcement caused.

To help you make an informed decision about whether to stay parked with Bench or move on to greener platforms, we’ve compiled this guide to outline the details of Bench’s closure, the top alternative accounting software providers and how to migrate to a new solution. Make sure to check out our quick-view table below to compare key features, pricing and customer reviews.

Whether you’re a startup, solopreneur, or established small business, there’s a Bench alternative out there for you. Let’s find the best fit for your business.

But first, some context.

Bench is shutting down. Or is it?

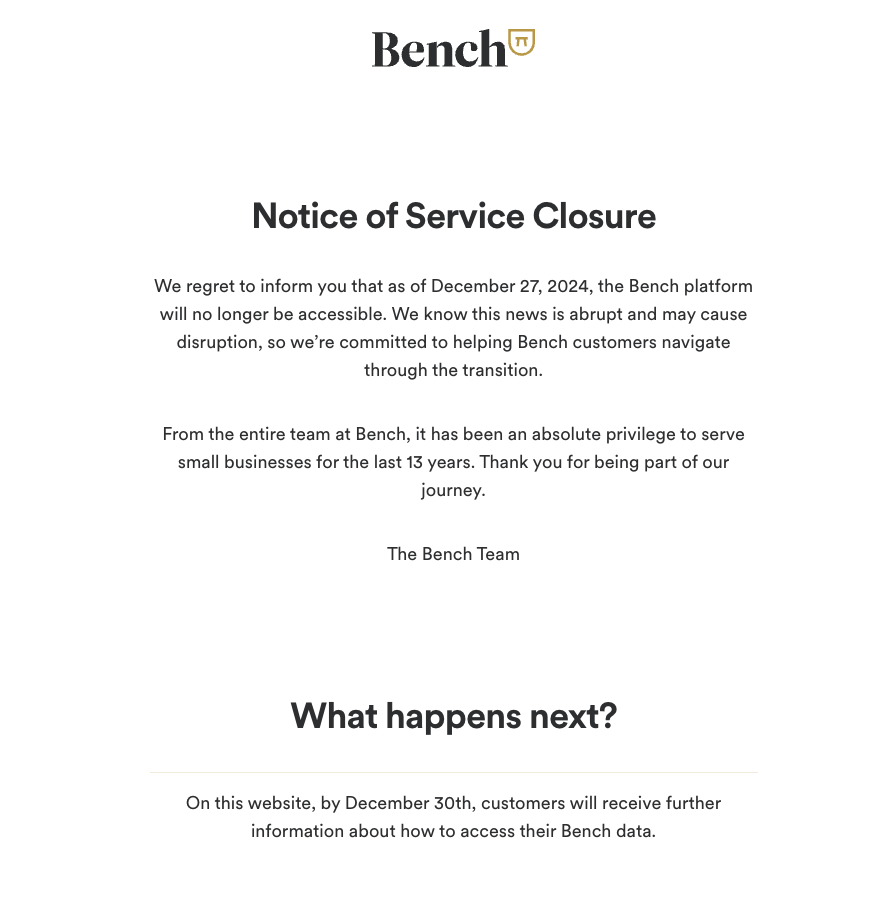

VC-backed bookkeeping platform Bench Accounting caused widespread panic among its customers after abruptly shutting down on Friday, December 27, 2024, locking thousands out of their accounts. The Vancouver-based start-up’s notice of closure left businesses that use its software scrambling for solutions, right as year-end and tax season loomed. But by the following Monday, payroll and onboarding tech company Employer.com announced its acquisition of Bench in a last-minute deal, and customer logins were restored.

But what about customer trust?

While plans are to revive Bench’s existing platform and allow customers to regain access to their data (with an option to either port their information or continue using the service as is), many challenges still remain. Chief among these is the impact of layoffs during the shutdown, which raises concerns about Bench’s service quality and platform reliability both during the transition and in the long term.

Bench’s former CEO and co-founder Ian Crosby released a statement on social media that further put into question the direction of the company over the past few years, following his abrupt dismissal.

Top Bench Accounting Alternatives

1. Pilot

Startup and small business focus: Pilot is an online bookkeeping and accounting service that caters to the needs of startups and small businesses. They offer bookkeeping, tax prep, and CFO services.

Accrual-basis accounting available: Unlike Bench, Pilot provides accrual-basis accounting in addition to cash-basis. This gives you a more accurate picture of your long-term financial health.

Integrates with top tools: Pilot connects with popular business tools like QuickBooks, Gusto, and Expensify to automatically import financial data. This saves time on manual data entry.

Pricing: Pilot offers three tiers, starting at $349 a month for Starter, $499 for Core and custom pricing for Plus.

Customer reviews:

“The consultative sales process made me confident in choosing Pilot for our accounting & tax needs, the onboarding process was smooth, and their online portal is eye pleasing, easy to use, and makes collaborating with our dedicated bookkeeper seamless.” Read more reviews from Capterra.

For a more detailed comparison of Pilot and Bench features, pricing, and reviews, check out this Pilot vs Bench comparison.

2. Finta

Built for startups: Finta offers a comprehensive, all-in-one accounting platform tailored specifically for startups, streamlining bookkeeping, taxes and financial insights within a single interface. This integration eliminates the need for multiple tools and services, providing real-time financial metrics such as cash flow, runway and burn rate, which are crucial for startup decision-making.

Ease of use for founders: Finta’s platform is designed to scale with startups, offering modern integrations with tools like Stripe, Gusto, Pulley and Carta, ensuring that as a startup’s financial management needs evolve, Finta can adapt accordingly.

Pricing: Finta offers three tiers, starting at $0 for Basic, $99 per month for Copilot and custom pricing for Assistant.Customer reviews: “Easy to use – Replaces spreadsheets and manual processes – More cost effective than competitor products – Unique approach to fundraising, making it easier to transfer funds from accredited investors.” Read more reviews from Capterra.

3. Kick

Automation and real-time insights: Kick automates bookkeeping tasks with real-time transaction categorization, personalized deduction management and customizable rules, providing immediate visibility into revenue and expenses.

Comprehensive financial tools: Offers features like multi-entity support at no additional cost, tax-ready financial statements and double-entry accounting for seamless collaboration with tax advisors or CPAs.

Scalable and efficient solution: Designed to save time and enhance accuracy, Kick outshines competitors like Bench by offering more robust tools such as real-time insights and automation, catering to modern business needs.

Pricing: Kick offers four tiers, starting with a free version, then moving to $35 per month for Basic, $125 per month for Plus and custom pricing for Enterprise.

Customer reviews: “I’ve had the chance to use Kick for a few months now, and as someone who does not like bookkeeping side of my business, I’m stoked there’s finally something user friendly and smart that I can use to automate my books. It’s literally built for businesses like mine, which are all online and have multiple streams of income.” Read more Product Hunt reviews.

Kick is the recommended solution by the Bench’s team and they offer a number of rewards for the customers who signup with them as part of the shutdown.

4. Quickbooks Online

Popular accounting software: QuickBooks Online is one of the most widely-used accounting solutions, with over 4.5 million subscribers worldwide. It offers a range of features for small businesses, including bookkeeping, invoicing, and financial reporting.

Advanced features available: While the basic QuickBooks plan includes essential bookkeeping tools, upgrading to a higher tier unlocks advanced features. These include inventory management, project profitability tracking, and budgeting.

Extensive app ecosystem: QuickBooks has its own app store with over 650 integrations for sales, marketing, operations, and more. There’s also a mobile app for accounting on the go.

Pricing: Quick Books offers four tiers, starting at $24, $54 for Essentials, $80 for Plus and $160 for Advanced. They also offer a free trial for 30 days and significant savings for the first six months.

Customer reviews: “I am enjoying using the online version and look forward to all the incentives for bringing and setting up clients, like revenue share and affiliate commissions. QB still remains the easiest and most valued bookkeeping software that I will recommend. There are video tutorials for literally everything.” Read more reviews from Capterra.

5. Fincent

Streamlined bookkeeping and tax support: Fincent combines intuitive software with human bookkeepers to deliver accurate, balanced books by the 15th of every month, alongside year-round support for business and personal tax filings.

Comprehensive financial tools: Features include simplified invoicing and billing, digital payment requests, and integration with payment methods like ACH, credit or debit cards, ensuring seamless financial operations.

Scalable and flexible solution: Offers support for both accrual and cash-basis accounting, integrates with tools like QuickBooks, and provides a modern, adaptable alternative to traditional services like Bench Accounting.

Pricing: Fincent offers three tiers, starting at $299 per month for Basic, $899 for Core and $1549 for Power.

Customer reviews: “Fincent takes care of everything related to accountancy and they did all the work I didn’t want to do. They just did it and made my life much easier. We are a graphic design studio and I was pretty new to accounting and bookkeeping. From the moment I started using Fincent, they took care of everything for me. They did the technical configuration, set up everything from scratch, and even set up everything for me to get my taxes done right.” Read more reviews from Capterra.

How to Choose the Right Bench Alternative

Finding the right replacement for Bench starts with understanding your business’s needs. Whether you prefer hands-on support or a DIY approach, here are the key factors to consider to make an informed choice.

Bookkeeping vs full-service accounting

Some Bench alternatives like Pilot and Finta offer bookkeeping and tax services, similar to Bench. Others like QuickBooks are DIY accounting software. Consider how much hands-on support you need.

Pricing model

Bench and the Bench alternatives listed above all charge flat monthly rates based on your monthly expenses, using various tiered subscription plans. In contrast, other bookkeeping services often charge hourly. Use your must-have features list (see tip in the migration guide below) to help you compare pricing models and find the best value for your business.

Automation features

Look for a Bench alternative that automates manual tasks like data entry, invoicing, and reporting. This will save you time and reduce errors.

Integration with existing tools

Choose an accounting solution that connects with the business tools you already use, such as your POS system, payment processor or payroll service. This will avoid duplicate data entry.

Reporting capabilities

Make sure your Bench alternative generates the financial reports you need for tax purposes and decision-making. These may include a profit and loss statement, balance sheet and cash flow statement.

Customer reviews

Read reviews from verified users on third-party sites like Capterra and G2 to see how each Bench alternative stacks up in terms of features, ease of use, customer service and value for money. Make sure to read both the pros and cons to get a realistic view of the software in regular use.

Step-by-step guide: How to migrate from Bench Accounting to a new provider

Follow these steps to ensure a seamless migration and set your business up for success with your new bookkeeping solution.

- Download your data

The first thing you should do is download all of your data from Bench. Login to the website (now restored) and follow the prompts to export your financial records. While there is no longer a deadline of Friday, March 7th at 5:00pm ET, it’s best to retain access to all your information as soon as possible.

- Schedule demos

Most accounting software and bookkeeping services offer free demos or trials. Take advantage of these to see the platform in action and ask questions.

- List your must-haves

Have a list of your must-have features and integrations ready before you go into these demos. This could include invoicing, payroll, or project tracking. Use this checklist to evaluate each alternative and ensure it meets your needs.

- Consider migration services

If you have historical financial data in Bench, look for an alternative that offers migration services to transition your records. Some may charge a fee for this.

- Allow a transition period

Give yourself time to get comfortable with your new bookkeeping solution. It may take a few months to fully transition from Bench.

- Notify stakeholders

If you switch from Bench to another bookkeeping service, notify any stakeholders who may be affected, such as investors, lenders or your accountant.

While it may take awhile to explore these Bench alternatives and find the solution that’s right for your business, this guide should give you a place to start the process. The key is to prioritize your business’s unique needs and take the transition one step at a time to ensure a smooth and effective switch.

Also looking for a complete business finance solution designed for Canadian businesses? Explore Float!

Try Float for free

Business finance tools and software made

by Canadians, for Canadian Businesses.

Get started for free and see how we can help you streamline your bookkeeping, invoicing and expense management.

Written by

All the resources

Industry Insights

Canada’s Crossroads: Why Now is the Moment to Move from Defensive to Intentional Growth

Float's 2025 report on Canadian business shows modest growth, rising costs and shrinking reserves. Find out exactly what the data

Read More

Expense Management

Controller Month-End Close Automation: Streamline Financial Reporting

Controllers, this one's for you. Let's talk about how how automating month-end close helps you move faster without sacrificing accuracy.

Read More

Corporate Cards

Corporate Card Program Implementation: Complete Management Guide

Ready to implement a corporate card program? This is where to start.

Read More