Finance Team Efficiency

Best Accounts Payable Platform in Canada in 2024

Discover the Best Accounts Payable Platform in Canada in 2024. Streamline your AP process, reduce errors, and boost efficiency with cutting-edge software. Compare features, pricing, and benefits to find the perfect fit for your company

August 30, 2024

Struggling to keep up with invoices and payments? Can’t find any modern, affordable products that are work reliably in Canada?

You’re not alone. Many Canadian businesses are on the hunt for the best accounts payable solutions to streamline their financial processes. Let’s review below the Best Accounts Payable Platform in Canada in 2024 and the other alternatives available on the market.

Why Bother with AP Automation?

Let’s face it – manual accounts payable is a drag. For instance, the institute of Institute of Finance & Management (IOFM) reports that:

It costs AP departments with no automation $6.30 (4x more costly) to process each invoice versus $1.45 in companies that utilize AP automation.

Institute of Finance & Management (IOFM)

Unfortunately, the banking portals have not evolved to support businesses needing to manage Accounts Payable at scale. The traditional solutions are:

- Time-consuming to initiate your payments manually from a bank account

- Error-prone to enter invoice details manually into your accounting system

- A total headache when you need to deal with an audit and you have no centralized record keeping for your AP

That’s where accounts payable automation comes in.

What to Look for in an AP Solution in 2024?

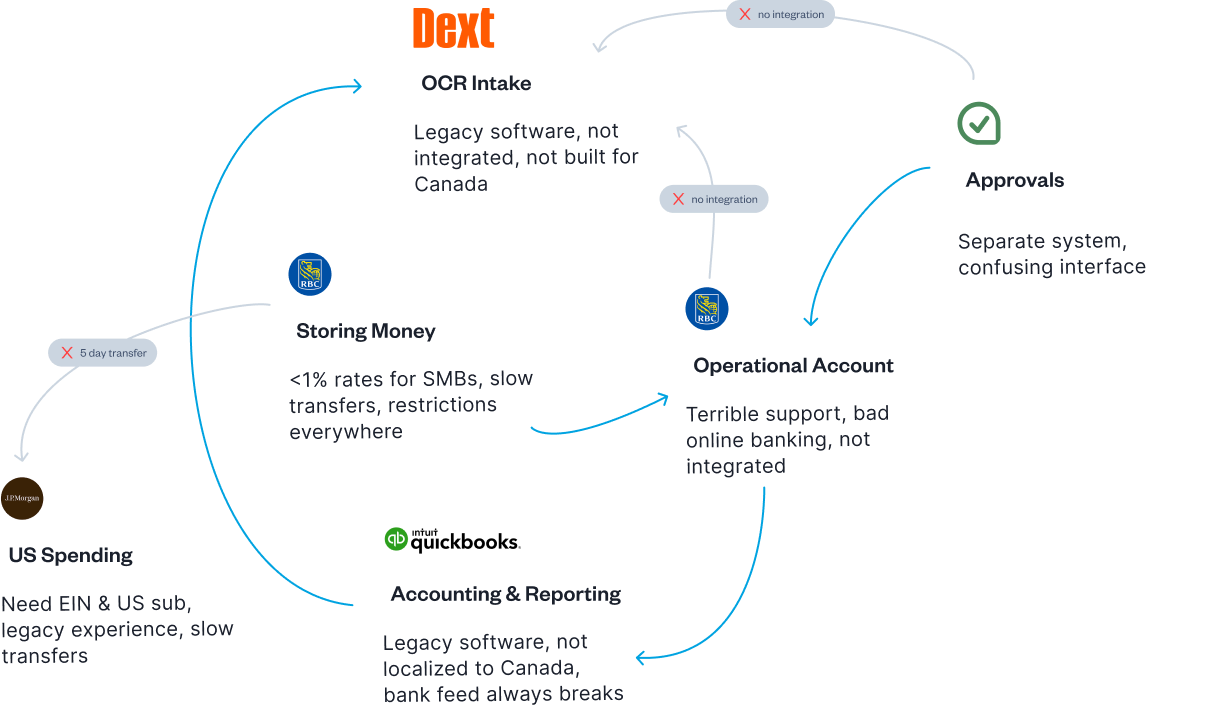

The messy “status-quo” in Canada

A lot of businesses are stuck with the same legacy setup for Accounts Payable in Canada in 2024. They use three or four separate tools just to manage the AP file:

- Dext or Hubdoc inbox for bill intake and OCR

- ApprovalMax for bill approvals

- Accounting system to track of the unpaid bills and schedule payments

- Bank portal to initiate money transfers

While this setup automates many parts of the AP process, it’s incredibly expensive, the integrations between softwares often break and need to be reconnected, and you are probably not going to save any time with this setup unless you are processing massive payments volumes every month.

The desired “state-of-the-art” solution

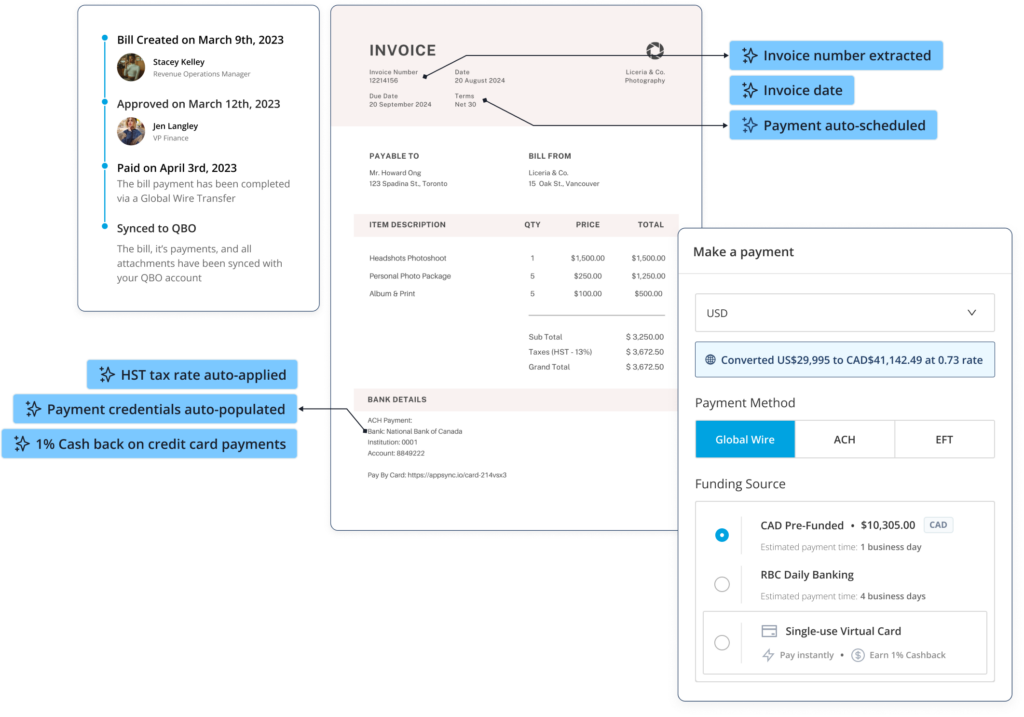

The ideal solution is a consolidated platform that features:

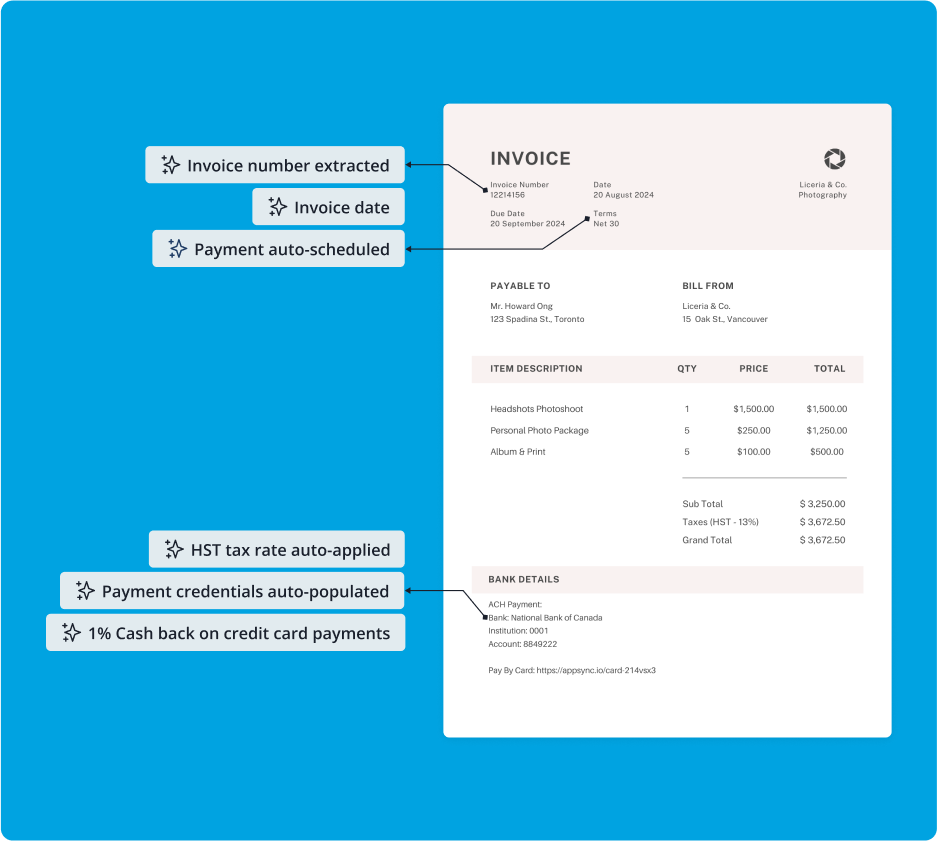

- Best-in-class AI document extraction experience

- Custom approval workflows

- Embedded EFT/ACH/Wire payments

- Built-in FX services

- Real-time two-way Accounting Sync

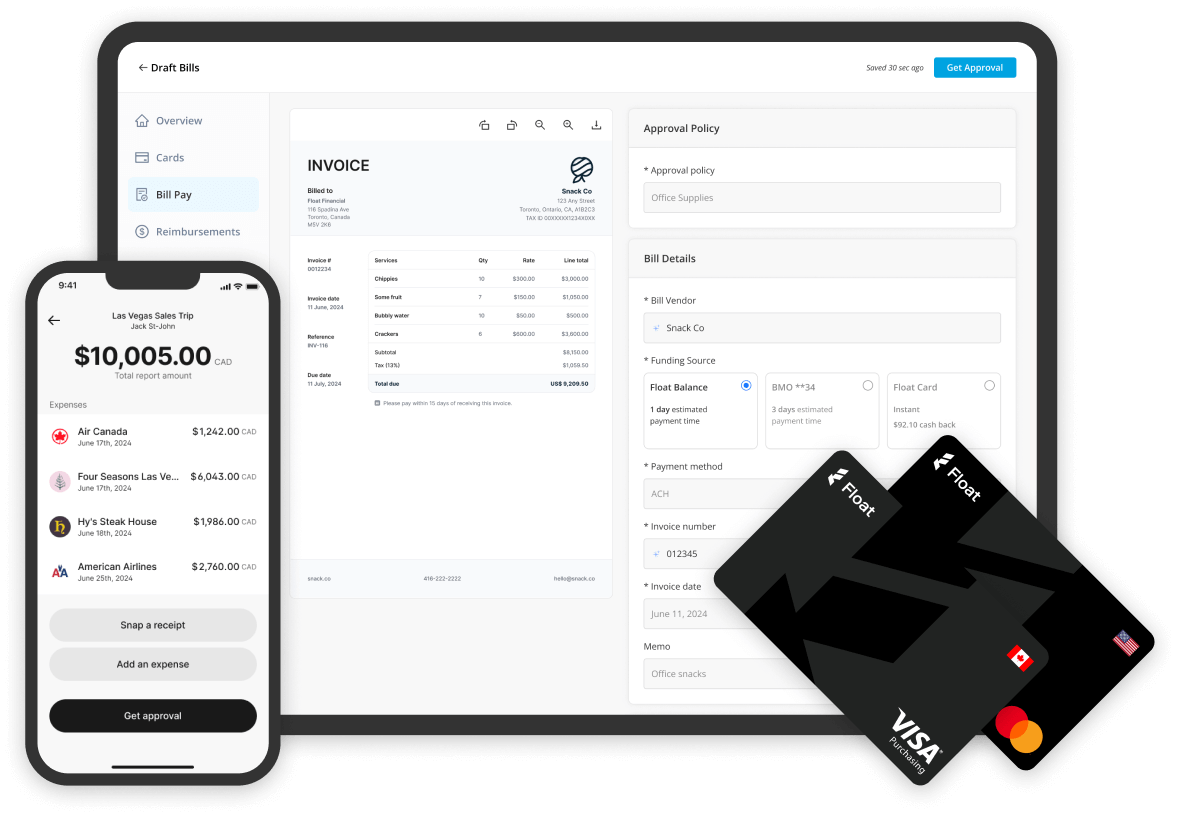

Good news, Float offers an all-in-one Accounts Payable solution for USD and CAD expenses.

Learn more about Float

Get a 10-minute guided tour through our platform.

Top Picks for Best Accounts Payable Platform in Canada in 2024

Now let’s review a few options for the best AP solution for businesses in Canada.

| Card Name | Costs & Fees | Overview | The Verdict |

|---|---|---|---|

| ⭐️ Float’s Bill Pay | SaaS: CAD $0 / mo. EFT/ACH fees: $1 / txn. | Best-in-class AI document extraction experience Custom approval workflows Embedded EFT/ACH/Wire payments (CAD / USD) Built-in FX services Real-time two-way Accounting Sync 4% interest on funds held with Float | Float is best-in-class and free all-in-one platform for Corporate & Virtual Cards, Expense Reports, and Accounts Payable. |

| Plooto | SaaS: CAD $32 / mo. EFT/ACH fees: $0.5 / txn. | Easy to use Payable solution Custom approvals to release payments Syncs unpaid bills from QBO/XERO | Plooto simple solution for micro-SMBs looking to make payments. However, it lacks software automation workflows and doesn’t any interest on deposits. Users have also reported slow payments, limited support, and inaccurate OCR results. Read more on why Canadian finance leaders choose Float vs. Plooto |

| Dext | SaaS: CAD $229 / mo. EFT/ACH fees: N/A | Great OCR solution Exports unpaid bills to QBO/XERO | Dext is a great OCR tool for bills and is often used to automate the intake process. However, Dext requires other solutions to facilitate bill approvals and payments and cannot be used as a stand alone end-to-end AP automation tool |

| Beanworks | SaaS: CAD $700 / mo. EFT/ACH fees: CAD $2 / txn. One-time Setup: CAD $4,000 No public pricing available. The pricing above was offered to a 100-employee company | Custom approval workflows Embedded EFT/ACH payments Two-way Accounting Sync | Beanworks is a powerful AP automation solution. However, it’s very pricey and interviewed users complained about poor accounting integrations and inaccurate OCR results. |

| RBC PayEdge | SaaS: CAD $0 / mo. EFT fees: CAD $1 / txn. ACH fees: CAD $10 / txn. | Embedded EFT payments Custom approvals to release payments Exports payments into QBO/XERO | RBC PayEdge is great for anyone looking to pay for bills from their bank portal. However, it offers limited software functionality and customers have reported complex user interface and poor support. |

Our recommended AP solution is Float. It combines ease of use, powerful automations, embedded payments, and seamless accounting integrations with QBO and XERO. Best of all, it’s free to use and you can sign up for Float in less than 5 minutes.

Thousands of Canadian businesses and brands like Knix, Neo, and Clutch have replaced their old AP solutions with Float.

“Float’s Bill Pay has become our main AP solution for Canadian business expenses. They built a product that is better than anything else on the market in Canada.”

Thomas Kwon

Head of Finance & Operations

Frequently Asked Questions

Float payments arrive next day when paid from the Float Balance (funds held in Float Balance earn 4% interest). Payments initiated from bank account arrive in 3-5 business days.

Yes, you must be incorporated in Canada or the US in order to signup for the Float’s Bill Pay product

Float supports CAD EFT/Wires, USD ACH, and Global USD Wires. Float also enables you to pay bills via Virtual cards to earn Cashback on your vendor payments.

While it’s difficult to compare OCR results business to business best in class solutions today should be able to extract line items, due dates, and banking details accurately and consistently.

Yes, Float offers physical and virtual USD/CAD cards that help eliminate FX fees and earn 1% cashback on your bill payments.

Float is Free to use on our Essentials plan, where you will be able to issue unlimited virtual CAD/USD cards, earn 4% interest on deposits, reimburse employees and pay vendor bills. If you need more sophisticated functionality, like over 20 physical cards, Netsuite integration, or an API solution, you will have to consider our paid Professional and Enterprise plans.

Unlike traditional cards that get you to spend more, Float is the only corporate card in the world that helps businesses spend less. Through a combination of financial rewards like our 1% cashback, 4% interest on deposits, no FX fees with our USD cards and time savings of at least 8 hours per employee Float’s customers on average save 7% on their spend.

Best Accounts Payable Platform in Canada in 2024 – Float

As we’ve explored the landscape of accounts payable solutions in Canada for 2024, one thing is crystal clear: AP automation is no longer a luxury—it’s a necessity for businesses looking to stay competitive and efficient.

If you are interested in getting your hands on the best AP solution for Canadian businesses, you should definitely consider Float’s solution:

- Best-in-class AI document extraction experience

- Custom approval workflows

- Embedded EFT/ACH/Wire payments

- Built-in FX services

- Real-time two-way Accounting Sync with QBO and Xero

- Finally, with Float you also get access to unlimited virtual and physical Corporate Cards and Employee Reimbursements.

—

Want to learn how companies like Clutch, Neo, Knix, and 1,000s of other Canadian businesses on average save 7% of their monthly spend with Float? Get started with Float today by clicking the button below!

Want to learn more before singing up? Book a demo today to learn more about the product from our team!

Written by

All the resources

Corporate Cards

How to Control Employee Spending: 5 Tips for Finance Teams

Employee spending out of control? These five tips for finance teams will help you control employee spending with ease, without

Read More

Corporate Cards

Corporate Card Alternatives: Comparing Your Options in 2025

Are your outdated cards slowing you down financially? Corporate card alternatives might be what will free you up — time-wise

Read More

Corporate Cards

No Annual Fee Business Credit Cards: A Smarter Way to Manage Spend

You don't need to be saddled by hefty annual fees to get the most benefits from your business cards. Here's

Read More