CASE STUDY

How Blue J Cut Foreign Transaction Fees and Scaled Financial Automation with Float USD Payments

Thousands

saved per month in FX fees on USD invoices

350+ hours

a year reclaimed across the business

Zero errors

with a seamless NetSuite sync

THE CHALLENGE

As Blue J scaled from 40 to 90 employees, their finance team faced mounting complexity—from managing FX fluctuations to tracking vendor spend across currencies. Paying USD vendors from Canadian accounts was costly and inefficient.

“Our bank had no good solution,” says Charlie Fazackerley CPA, Director of Finance at Blue J. “They offered hedging programs meant for large enterprises, but we needed something simple and effective.”

Meanwhile, manual reimbursements and centralized expense management were creating bottlenecks as the team grew. Charlie was spending hours each pay cycle chasing receipts and approvals, time that could have been used for strategic work.

THE SOLUTION

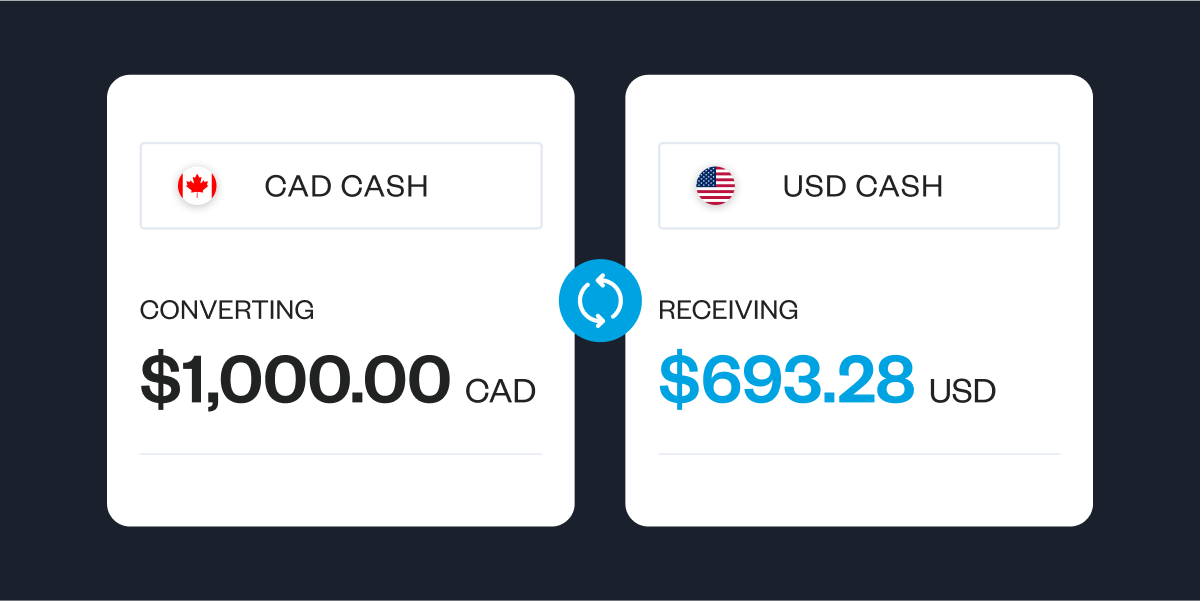

Float’s USD accounts unlocked a new level of efficiency for Blue J. The team funded a USD account in Float and issued dedicated USD virtual cards for their US vendors, paying directly in USD and eliminating FX conversion costs entirely.

“The moment we moved our USD vendors to Float, we stopped losing money on FX,” Charlie says. “We fund our USD account in Float, we pay in USD, and there’s no guesswork.”

Float also helped Blue J scale internal controls as they expect their team to grow to 100 employees before year end. With custom team approvals and vendor-level cards, department heads now have real-time oversight without finance acting as a bottleneck.

And with Float Reimbursements, employees no longer waste time on Excel reports or slow payroll reimbursements. They simply drag and drop receipts for instant approval and fast payouts directly into their bank accounts.

THE RESULTS

- Thousands saved in FX costs each year, with $100K per month of USD invoices

- 350+ hours/year reclaimed across finance and teams

- Eliminated manual spreadsheets and payroll reimbursements

- Zero reconciliation errors with NetSuite integration

- Full visibility and control as the team doubled in size

About Blue J

Blue J is a Toronto-based legal technology company helping professionals make better decisions through AI-driven insights. Operating across North America with a rapidly growing team of 100 employees, Blue J serves legal and tax professionals with innovative software solutions that bring clarity to complex legal research and analysis.

THE DETAILS

Before Float introduced USD payments, Blue J was paying US vendors in Canadian dollars, losing up to 3% FX fees on each transaction. “Our bank was so rigid we had to ask permission to spend our own money,” Charlie says. “They suggested hedging strategies that made no sense for a small business.”

Switching to Float solved that instantly. With USD funding and cards, Blue J cut unnecessary costs and gained total visibility into cross-border spend. The team also eliminated all traditional credit cards from their bank, removing the need for manual entry into NetSuite and the headaches that came with fraud management on physical cards.

At the same time, Charlie used Float to automate approvals and reimbursements as the company doubled in size. Before Float, the team was considering hiring someone or outsourcing payroll just to handle the volume of reimbursements. “I was spending 100 hours a year just on manual reimbursements,” she says. “Now it’s automatic.”

“The moment we moved our USD vendors to Float, we stopped losing money on FX.”

Charlie Fazackerley CPA, Director of Finance at Blue J

The rollout was effortless. Charlie tested the reimbursement feature with one employee who bought a mouse for her desk. The process was so simple that when Charlie brought it to her CFO, he approved immediately “because it’s already in a platform we know and trust.” They created a one-page guide for staff, but employees didn’t even need to read it. Everyone had an a-ha moment when they realized, “Oh, you just drag and drop the receipts. It’s really easy,’ Charlie says. “We didn’t even have to train anybody.”

An equally big win came at month-end. The reliability of Float’s NetSuite integration was a game-changer. “We use lots of APIs and they break constantly. Float has never missed a transaction. If it shows as exported, it’s perfect.”

That reliability transforms month-end close. While other integrations regularly drop transactions, forcing hours of reconciliation work, Float’s sync is flawless. “When I get to the end of the month, if all those transactions show as exported in Float, I know it’s going to reconcile,” Charlie says. “I don’t need to spend hours hunting for what was missed.”

Beyond the efficiency gains, Float freed Charlie to focus on high-impact work. “With that time back, I found grant funding for the business and started automating our revenue process. Float literally gave me the space to work on growth.”

“Float has never missed a transaction. If it shows as exported, it’s perfect.”

Charlie Fazackerley CPA, Director of Finance at Blue J

Explore more customer stories

Learn more about Float

Get a 10-minute guided tour through our platform.

Makeship

Float provides seamless management in both CAD and USD currencies, while decreasing time spent on month-end by 60%.

Coastal Reign

Float cards are issued to a quarter of their team, providing immediate access to spend capital in order to do their jobs more efficiently.

Practice Better

“Where it took 12 days before, I can now close expenses in one or two days. It just reconciles so easily.”