Corporate Cards

Merchant-Specific Spending Controls: Implementation Guide

Learn how to implement merchant-specific spending controls. Discover best practices and tools to manage employee expenses effectively.

August 6, 2025

Even well-meaning teams can swipe the wrong card or accidentally bend the rules. One software subscription here, a lunch order there, all add up. That’s why merchant-specific spending controls are a finance team’s best friend.

Nobody wants to roadblock a productive team. However, managing cash flow is one of the top three business challenges for small business owners who are experiencing uncertainty. These corporate card controls, including merchant-specific spending, allow you to rein in spending without micromanaging your team.

In this guide, we’ll walk through what merchant category and vendor-based controls are, how to implement them effectively and how Float makes it simple to enforce policies without slowing anyone down.

What are merchant-specific spending controls?

Let’s start with the basics. Merchant-specific spending controls limit the use of corporate cards to designated locations and purposes.

These limits include:

Merchant category controls (MCC blocking)

These determine which categories of merchants are allowed or blocked. For example, a software card might be blocked from being used at restaurants, or a gas card may be restricted to fuel-only purchases.

Vendor-specific setups

While Float doesn’t block individual vendors by name (e.g. Amazon or DoorDash), you can configure vendor-dedicated cards with merchant category blocking, spend limits and automated tags. That effectively achieves the same outcome and keeps your accounting team smiling.

Merchant category controls work by using standard merchant category codes (MCCs) or industry-assigned identifiers that categorize businesses, such as “Advertising” or “Hotels.”

Just note: Your corporate card or expense management software (whatever you are using to set merchant-specific spending controls) typically doesn’t assign these categories. The merchant’s payment processor does.

This approach shifts employee spending management from post-purchase damage control to preemptive peace of mind. Instead of discovering that someone signed up for a new app on the team lunch card, Float can automatically decline the charge at checkout and notify the cardholder.

There are a few exceptions. Executive cards, for instance, may be left open if they need to handle a wide range of purchases. But for most employees, defaulting to category-based or vendor-specific controls is the smarter move.

Why merchant controls matter more than ever

Finance teams must juggle rapid growth, distributed teams, and increased oversight. The risk of accidental (or off-policy) spend is real, especially when team members don’t always know what’s allowed, or when finance can’t see spending in real time.

Here are a few ways implementing merchant-specific spending controls can help.

Prevent unauthorized or non-compliant spending

Whether it’s someone accidentally using their team lunch card to sign up for a new app or testing out software without approval, merchant controls stop that spend at the point of sale.

Avoid waste on unapproved tools or services

A forgotten subscription or unvetted vendor can make it easy to lose money on services you didn’t mean to pay for.

Reduce reconciliation work

Pre-approved spending means fewer mysteries to solve when month-end rolls around. It’s also easier to automate accounting when transactions follow predictable patterns.

Support financial policy compliance

For nonprofits, public entities or companies with strict guidelines, these controls make it easier to stay audit-ready, without making finance the bad guy.

Key features to look for in merchant control tools

Not all corporate card controls are created equal. Look for features that offer flexibility, automation and the ability to scale with your team.

At a minimum, your platform should include:

- Merchant category blocking and allowing

- Vendor-level card configurations

- Whitelisting or blacklisting capabilities

- Role- or department-based rule creation

- Spending limit controls by amount, vendor and timeframe

- Real-time alerts when spend goes off-policy

- One-time use card support (auto-deletes after first transaction) and temporary spending limits

- Custom rule configurations for different teams or use cases

With providers like Float, you can also layer on automation. For example, you might set up a card to only allow software purchases up to $500/month, auto-tag them to a specific GL account and send an alert if something falls outside that range.

How to implement merchant category controls effectively

Setting up employee spending management doesn’t have to be complicated. For best results, however, you’ll want some upfront thinking in the mix.

Here’s a simple rollout plan you can use for the implementation of merchant category controls.

1. Identify high-risk or frequently misused categories

Think of categories like restaurants, software or subscriptions: areas where spend can easily drift outside policy. Start by locking these down with merchant category blocking.

2. Align controls with internal policies

If your expense policy doesn’t allow spending on certain vendors or types of purchases, make sure your controls reflect that. It’s easier to enforce rules when they’re baked into the card itself.

3. Set up controls by card, team or project

Create cards for specific vendors or types of spend. You might have a shared “office expenses” card for low-cost supplies, and individual cards with MCC restrictions for team leads managing specific budgets. This makes it easy to know where every dollar goes and empower your team to move fast while still controlling employee spending.

4. Monitor usage and iterate

Keep an eye on spending patterns. If cards are constantly getting declined for valid reasons, it may be time to adjust the rules. Don’t be afraid to tweak things as your needs evolve.

5. Communicate with cardholders

The best spending limit controls are ones that employees understand. Let your team know what’s allowed, what’s not and who to contact if a charge is declined. Surprises at the checkout aren’t a great look, especially when it’s the CEO’s coffee order getting a chilly reception.

Compare top options, fees and benefits for

Canadian companies.

Best business credit cards

How Float makes merchant-specific spend control simple

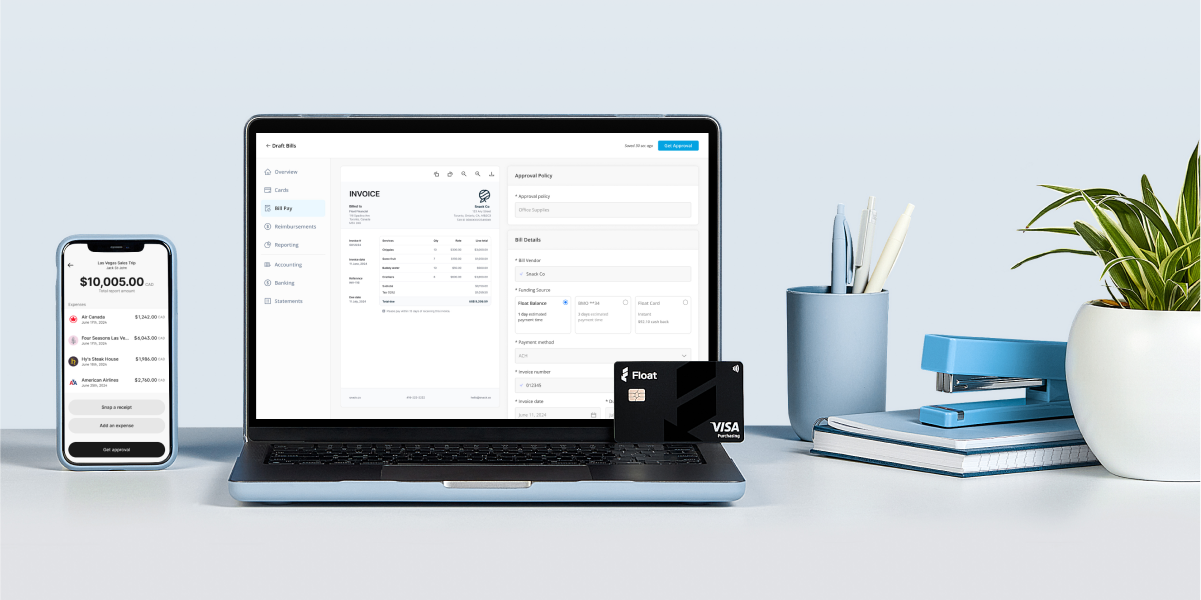

Float takes the heavy lifting out of financial policy compliance by putting controls on the cards themselves, where they belong.

With Float, you can:

- Set real-time controls at the card level

- Apply merchant category blocking

- Create vendor-specific configurations with built-in limits

- Combine rules by amount, vendor, category and timeframe

- Automate GL coding and policy alerts

- Configure approval workflows that match your expense policy

- Issue one-time cards that delete after a single use

And the best part? You can do all of this without turning your finance team into full-time hall monitors. Float lets you spend less time policing and more time planning.

Float: Real control without micromanagement

You shouldn’t have to chase receipts, guess who bought what or wonder why someone signed up for a new SaaS tool on the office pizza card.

With merchant-specific spending controls, you can prevent problems before they happen and empower your team to spend confidently within clear guardrails.

Float makes it easy to roll out these corporate card controls, customize them for your business and automate the approval and accounting processes behind the scenes. It’s employee spending management that works for everyone, not just finance.

Try Float for free

Business finance tools and software made

by Canadians, for Canadian Businesses.

Written by

All the resources

Cash Flow Optimization

ACH vs EFT Payments: Key Differences for Canadian Companies

Learn the key differences between EFT and ACH payments, how they work, which options might be available to your business

Read More

Corporate Cards

Xero Integration for Corporate Cards: Modern Accounting Software Guide

Using Xero becomes more powerful the second you integrate it with your corporate cards. Here's what you need to know.

Read More

Float News

Float 2025: Year in Review

How Float is building the financial system Canadian businesses run on

Read More