Corporate Cards

Top Five Use Cases for Virtual Cards in Canadian Businesses

Discover the top 5 use cases for virtual cards in Canadian businesses. Streamline expenses, enhance security, and boost efficiency with Float’s solutions.

September 24, 2024

As a Canadian business owner, you’re always looking for ways to streamline operations, reduce costs, and improve security. Virtual cards can help you achieve all of those goals and more. In this article, we’ll explore the top 5 use cases for virtual cards in Canadian businesses and show you how they can benefit your company.

Virtual cards are a powerful tool that can transform the way you manage expenses, pay vendors, and control spending. By understanding the key use cases and benefits, you can make an informed decision about whether virtual cards are right for your business.

What are virtual cards?

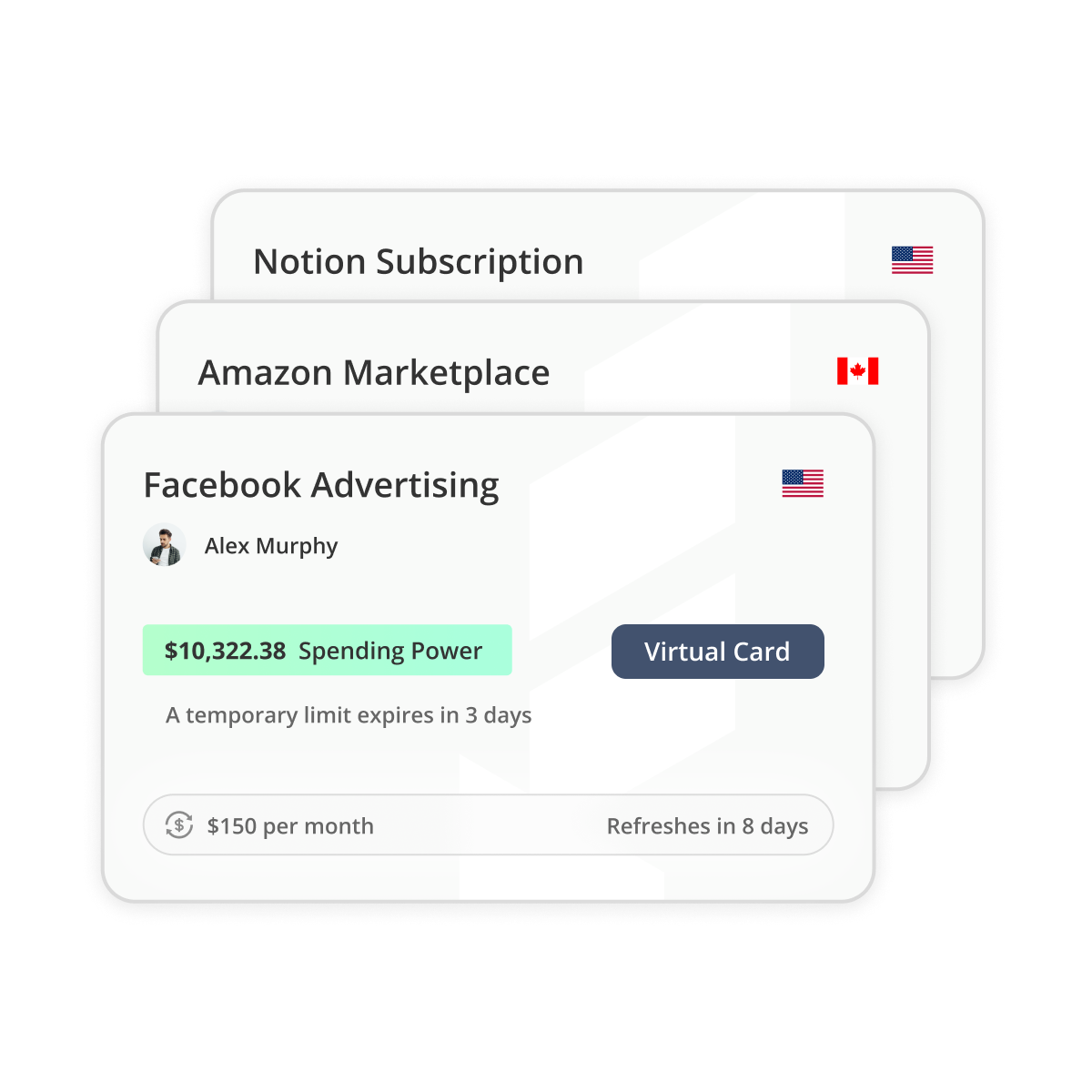

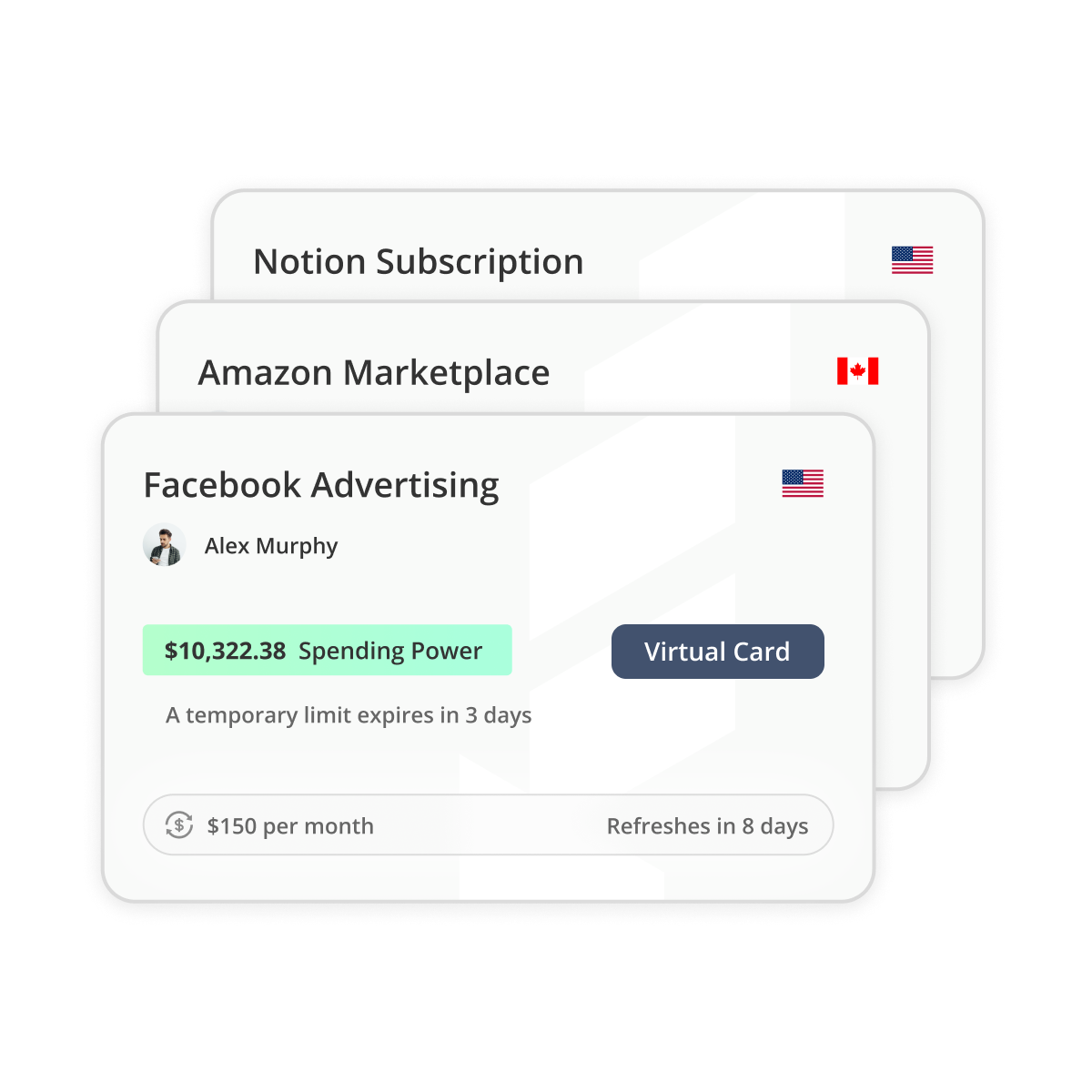

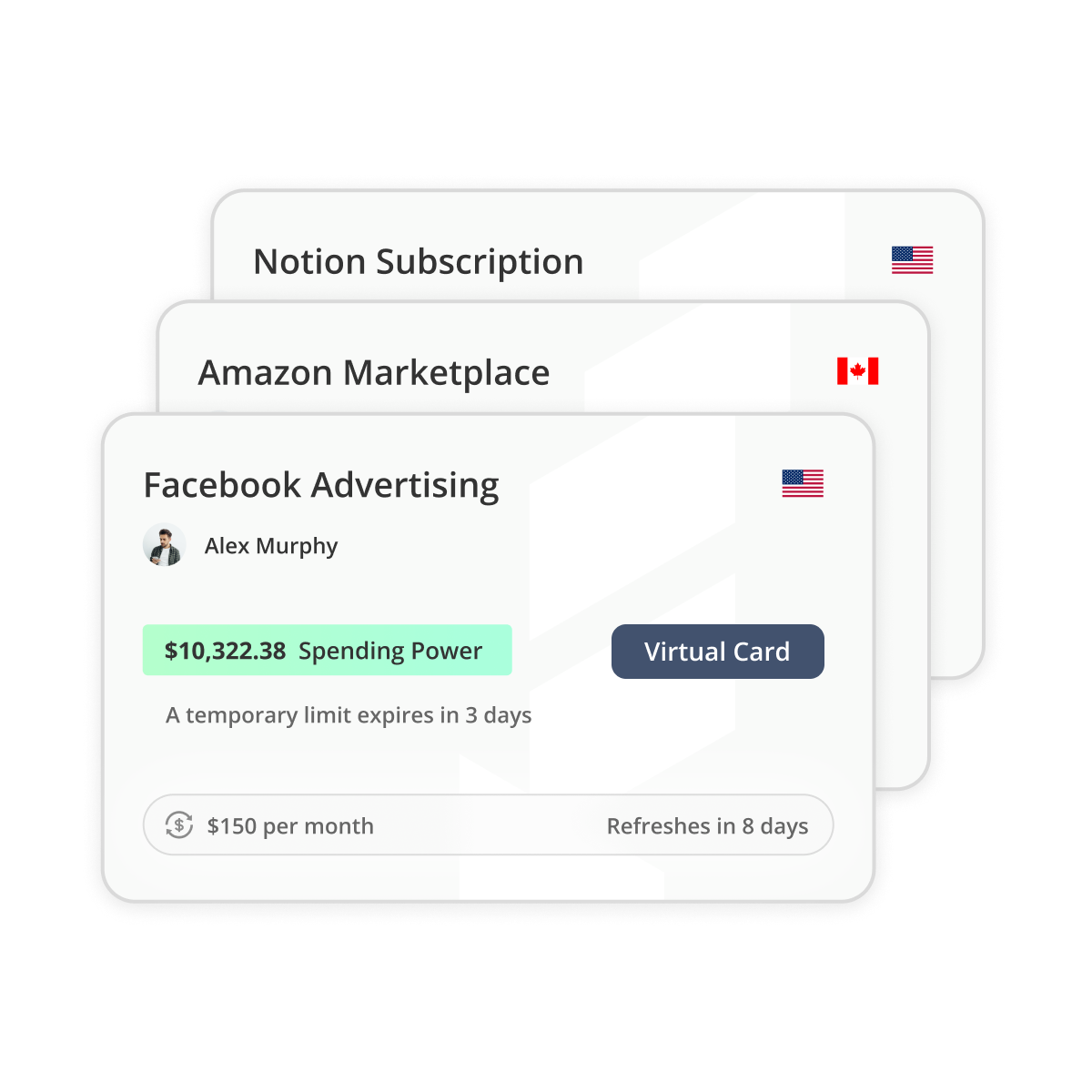

Virtual cards are a type of digital corporate credit card numbers that provide an extra layer of security for online transactions. They function like regular credit cards but are not physical, plastic cards. Virtual cards can be instantly issued and come with enhanced controls like spend limits and expiration dates. Read more about the history of virtual cards in our deep dive — Discover: Virtual Credit Cards for Canadian Businesses

Instantly Issue Unlimited Virtual Cards with Float

Canada’s only modern USD and CAD Visa and Mastercard virtual cards solution for businesses — plus cashback and average savings of 7%.

Secure vendor payments

- Protect your primary credit card: Virtual cards allow you to pay vendors without exposing your primary credit card number.

- Prevent overcharging: You can set custom spend limits for each vendor to prevent overcharging.

- Set expiration dates: Automatically set the virtual card to expire after a single use or on a specific date.

- Earn rewards: Earn cash back rewards on vendor spend while maintaining tight control.

Simplify employee expenses

- Provision virtual cards for specific purchases: Provision virtual cards to employees for specific purchases like travel, supplies or subscriptions.

- Eliminate expense reports: Eliminate the need for employees to use personal cards and submit expense reports.

- Set budgets and track spending: Set budgets for each virtual card and track spending in real-time.

- Automate expense management: Automatically capture receipts and export expense data to your accounting system.

Manage subscriptions and recurring payments

- Create virtual cards for each subscription: Create virtual cards for each subscription or recurring bill.

- Prevent surprise increases: Set the exact amount to be charged each billing cycle to prevent surprise increases.

- Schedule automatic cancellation: Schedule the virtual card to cancel on the subscription end date.

- Easily update payment details: Easily update payment details if you change credit card providers.

Control online advertising spend

- Manage ad spend by platform: Use virtual cards to manage spend on Google, Facebook, and other online ad platforms.

- Set proactive spend limits: Proactively set daily, weekly or monthly spend limits to keep campaigns on budget.

- Get real-time visibility: Get real-time visibility into ad spend by campaign, platform and region.

- Maintain budget flexibility: Maintain flexibility to increase budgets for high-performing campaigns.

Streamline reconciliation and reporting

- Automate transaction syncing: Virtual card transactions automatically sync to your accounting system.

- Capture detailed transaction data: Capture detailed information like merchant name, amount and date for each transaction.

- Assign GL codes for faster close: Assign GL codes to virtual cards for faster month-end close.

- Generate spend reports: Generate spend reports by employee, department, vendor or expense category.

Instantly Issue Unlimited Virtual Cards with Float

Canada’s only modern USD and CAD Visa and Mastercard virtual cards solution for businesses — plus cashback and average savings of 7%.

Frequently Asked Questions

Float’s virtual cards are issued by Visa for CAD cards and Mastercard for USD spending. They offer direct 1% cashback on all categories after the first 25K of monthly spend. Float operates on a Charge Card or Prepaid funding model. Prepaid model offers 4% interest on all deposits with no cash lockups with account opening in < 24 hours.

Virtual cards are the same as a traditional physical card with the exception that the card number for these cards is presented digitally. You can create and cancel virtual cards for any purchase and set custom limits on a per-card level to avoid overcharges from the vendors. Float’s virtual cards are excellent for recurring subscription expenses, digital ads spend, and one-off small employee purchases as they can be added into Apple or Android Wallet and deleted once the purchase is complete. Float’s Essentials plan offers unlimited virtual cards and <10 minutes account application time.

Signing up for Float takes less than 10 minutes and can be done fully online. Float does not require any personal guarantees and does not perform credit checks to open your account. Ready to get started on our Free Essentials plan? Sing-up today.

Float is Free to use on our Essentials plan, where you will be able to issue unlimited virtual CAD/USD cards, earn 4% interest on deposits, reimburse employees and pay vendor bills. If you need more sophisticated functionality, like over 20 physical cards, Netsuite integration, or an API solution, you will have to consider our paid Professional and Enterprise plans.

Float offers Charge Card and Prepaid funding models. You can apply (*Conditions apply. Book a demo to learn more) for unsecured, 30-day credit terms with high limits up to $1M, no credit checks and personal guarantees. Prepaid model offers 4% interest on all deposits with no cash lockups with account opening in < 24 hours.

Unlike traditional cards that get you to spend more, Float is the only corporate card in the world that helps businesses spend less. Through a combination of financial rewards like our 1% cashback, 4% interest on deposits, no FX fees with our USD cards and time savings of at least 8 hours per employee Float’s customers on average save 7% on their spend.

Unlock the Power of Corporate Virtual Visa Cards with Float

Float’s Virtual Visa Cards provide Canadian businesses with a complete virtual card solution. With unlimited cards, 1% cash back on every purchase, and powerful spend management software, Float makes it easy to control expenses and streamline operations. Plus, you can instantly issue cards, set custom limits, and automate reconciliation – all from one intuitive platform.

Ready to take control of your business expenses with virtual cards? We’re here to help you every step of the way. Get started for free with Float today and discover how our powerful virtual card solution can transform your financial operations.

“Float’s virtual cards continue to give our team the flexibility and autonomy they need and deserve.”

Andy O’Reilly

Senior Manager of Finance & Technology

Written by

All the resources

Industry Insights

Canada’s Crossroads: Why Now is the Moment to Move from Defensive to Intentional Growth

Float's 2025 report on Canadian business shows modest growth, rising costs and shrinking reserves. Find out exactly what the data

Read More

Expense Management

Controller Month-End Close Automation: Streamline Financial Reporting

Controllers, this one's for you. Let's talk about how how automating month-end close helps you move faster without sacrificing accuracy.

Read More

Corporate Cards

Corporate Card Program Implementation: Complete Management Guide

Ready to implement a corporate card program? This is where to start.

Read More