Corporate Cards

Best Business Virtual Corporate Cards in Canada in 2026

Discover the Best Business Virtual Credit Card in Canada in 2025. Compare top options from major banks, explore rewards, fees, and benefits.

July 5, 2025

As part of a Canadian finance team, you know that finding the right virtual corporate credit card is key to streamlining expenses, improving cash flow and gaining better control over spending. With so many options available in 2026, it’s essential to understand the unique features and benefits that distinguish certain corporate cards from the rest.

When searching for the best virtual corporate card for Canadian finance teams, consider factors like instant card issuance, customizable spending limits, integration capabilities with accounting software and the level of security provided. By assessing these elements and aligning them with your company’s financial goals, you can make an informed decision that will help drive your business forward.

What are virtual corporate cards?

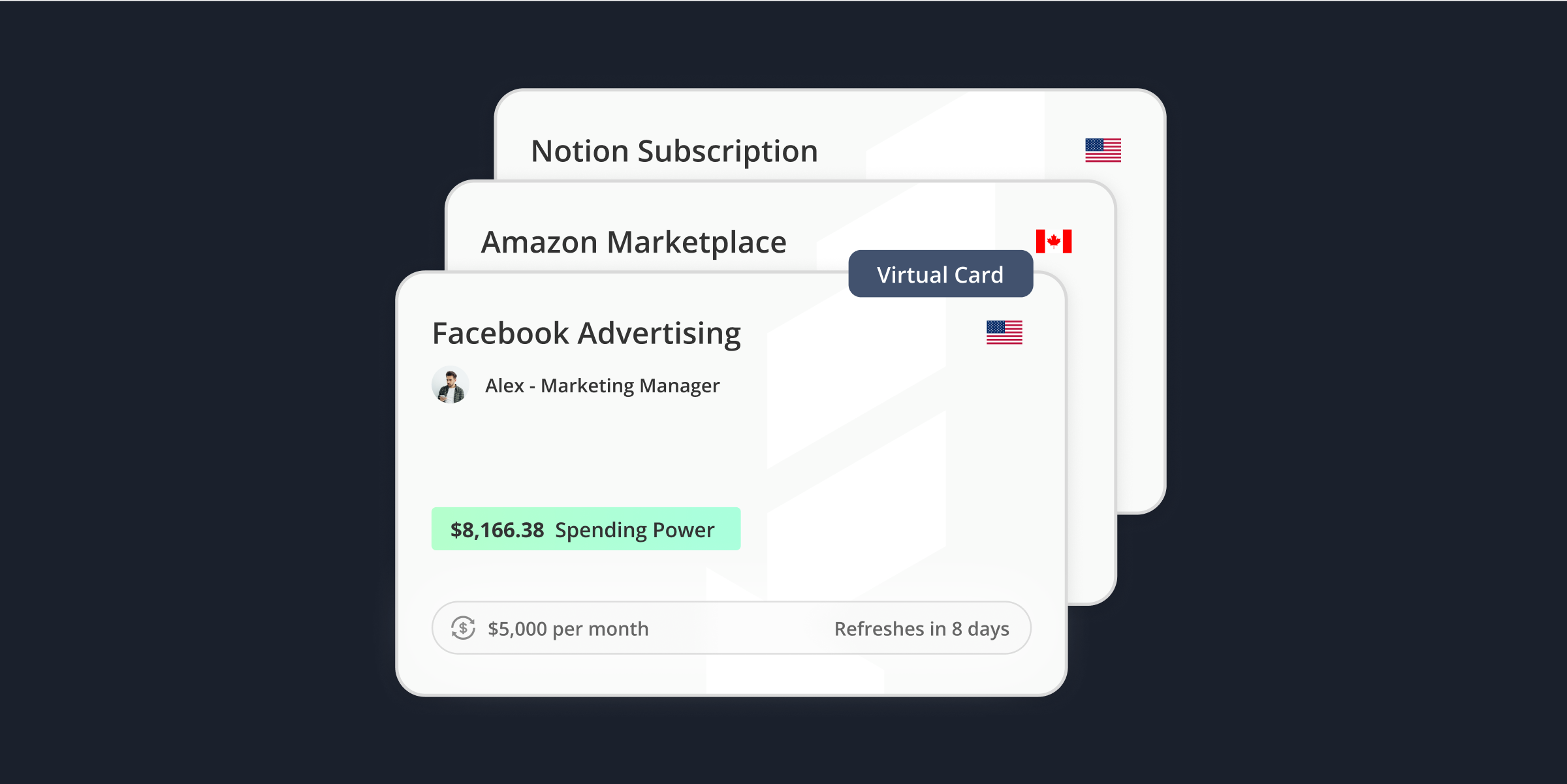

A virtual corporate card is a randomly generated 16-digit number that is linked to your company’s existing corporate credit card account. This means your team can make purchases online without exposing your actual corporate credit card details, adding an extra layer of security to your transactions.

Although transactions completed with a virtual card use a separate card number, they will still appear on your company’s regular credit card statement, making it easy to track spending.

Pro tip: Want to get more intel on virtual credit cards as a whole? Read more about the history of virtual cards in our deep dive article, Discover: Virtual Credit Cards for Canadian Businesses

Virtual corporate cards vs. virtual credit cards: Key differences

Virtual corporate cards and virtual credit cards are often used interchangeably, but there are some key distinctions that are important in a business context. A virtual corporate card is linked to your corporate account (either a prepaid account or charge account) while a virtual credit card is linked to your personal credit or business credit card account. Virtual credit cards have limited controls, spend management, and other integrations, making them less ideal for team-based business spending.

On the other hand, while both types of virtual cards utilize randomly generated 16-digit numbers and add a layer of security when making online purchases, virtual corporate cards offer several benefits specifically designed for Canadian finance teams and businesses.

Virtual corporate cards linked to corporate accounts typically have higher limits compared to personal virtual credit cards. Some virtual corporate card providers, like Float, include expense management software that provides detailed real-time visibility into spending in addition to custom controls to keep expenses in check.

Why use a virtual corporate card?

Virtual corporate cards have gained significant popularity among Canadian startups due to their convenience and flexibility. These digital payment solutions offer a range of features designed to simplify expense tracking, enhance security and provide greater control over spending.

Incorporating virtual corporate cards into your startup’s financial management strategy can yield numerous benefits for your business, including:

- Enhanced security: By generating unique corporate card numbers for each transaction, virtual cards minimize the risk of fraud and unauthorized purchases.

- Simplified expense management: With virtual cards, you can bid farewell to traditional expense reports. Transactions are automatically categorized and synced with your accounting system, saving time and reducing manual data entry.

- Flexibility for one-off purchases: Virtual cards are ideal for single-use scenarios, such as purchasing a new software service. You can create a card specifically for that purpose and deactivate it once the transaction is complete.

- Enhanced vendor management: With a virtual corporate card, you can create vendor-specific virtual cards. This makes it easy to oversee recurring bills and large one-time vendor payments.

- On-track project budgets: Use virtual corporate cards to stay within project budgets. Create a virtual card for each major project to keep a closer eye on spending. Simply deactivate the card once the project is over.

- Controlled department spending: Stay on top of departmental budgets by assigning a virtual corporate card number for each department. Temporarily increase or decrease spending limits based on organizational priorities and departmental needs.

Key features to look for in a virtual corporate card or credit cards in 2025

When evaluating virtual card options for your Canadian business, there are several key features to consider:

- Instant card issuance: Look for providers that offer immediate access to virtual cards upon approval, allowing you to start making purchases right away. Some options can take days or weeks.

- Customizable spending limits: Look for cards that enable you to set specific spending limits for each virtual card, giving you greater control over employee expenses.

- Integration capabilities: Choose a virtual card that seamlessly integrates with your existing accounting software, which allows automated expense tracking and reconciliation.

No credit check virtual card options in Canada

For startups with limited credit histories, some providers offer virtual cards that do not require a credit check. These options assess your business’s financial health based on alternative data points, such as bank account activity and cash flow. Float is among the providers that offer no credit check virtual cards, making them accessible to a broader range of businesses.

Virtual corporate cards for employee management

With virtual corporate cards, Canadian finance teams can simplify the management of employee spending. This saves hours at month-end while providing individuals and teams with the flexibility they need to keep up with the pace of modern business.

Finance teams can delegate virtual corporate cards to key individuals for one-off or recurring expenditures, such as for projects or departmental spending. Similarly, you can also create virtual corporate cards for multiple users, such as within teams or business groups. Set custom spending limits and adjust them as needed.

Virtual cards also provide detailed oversight for finance teams. You get real-time visibility and flexible controls without having to micro-manage spending. Plus, virtual cards simplify expense reports as receipts can be automatically sent to you for reconciliation.

Virtual corporate cards approval workflows

Slow approval workflows can bring business to a halt, even causing your company to miss time-sensitive opportunities. With virtual corporate cards, you can expedite the entire spending approval process.

Administrators and managers can approve, edit or deny spending requests from employees, setting custom spending limits for individuals or teams on virtual corporate cards. Whether it’s for a departmental or project budget, employees don’t need to follow up with managers for approvals as automatic notifications keep the process moving.

Plus, each virtual card features a detailed audit trail for simplified tracking. Transactions are auto-coded, providing managers and finance teams with clear visibility into spending at all times.

Top picks for Canadian virtual corporate cards

Let’s review a few of the best virtual cards for businesses in Canada.

| Card Name | Provider | Annual Fee | Rewards | Key Benefits | Key Drawbacks |

| ⭐️ Float Virtual Visa Card | Float Visa & Mastercard | $0 (Unlimited Virtual Cards) | Unlimited 1% cashback on every dollar of spend over $25K. No annual or monthly cashback caps. Total of 7% in estimated savings (learn more) | • Real-time expense tracking• Unlimited Virtual Cards• No personal guarantee• 4% interest on deposits | • No travel rewards |

| RBC Virtual Card | Visa | $175 ($79 for additional cards) | 1 point per $1 on all purchases. Capped out at $75k per year. When applied to a statement credit, 1 point is equivalent $0.58 (0.58% cashback) | • Point-based reward system for Travel• Device insurance | • Only for existing RBC Commercial cardholders• Must talk to the sales team or visit a branch to access |

| Wise Virtual Card | Visa Debit | Free | 0.5% cashback on eligible transactions | • Low FX rates compared to traditional banks | • Limited Cashback• No protection plans or insurance |

| BMO Payment Controller | Mastercard | Paid – Talk to Sales | No Cashback or rewards found on the website | • Web portal to manage cards | • Only for existing BMO Commercial cardholders• Must talk to the sales team or visit a branch to access |

We’ve considered factors such as:

- Annual fees: Look for cards with low or no annual fees to minimize overhead costs.

- Interest rates: If you plan to carry a balance, opt for cards with competitive interest rates to minimize the cost of borrowing.

- Rewards programs: Some business credit cards offer cashback, points or miles on purchases, which can add up to significant savings over time.

- Ease of use and signup: See how quickly you can access issuing cards and set up your account. Your virtual card won’t be of any use if it takes weeks to get set up.

By carefully evaluating these factors and aligning them with your business needs, you can find the best virtual corporate card to support your startup’s growth and financial well-being in 2025 and beyond.

Our recommended business virtual card is Float. It combines ease of use and powerful rewards, and doesn’t require personal guarantees to get started. Plus, you can sign up for Float in less than five minutes.

Float: Best virtual corporate cards for Canadian SMBs in 2026

Choosing the best virtual business card in Canada isn’t just about finding the shiniest piece of plastic. It’s about finding a financial tool that aligns with your business goals and spending habits.

Whether you’re after cash back, travel perks or building credit, there’s a card out there for you. Take the time to compare options, read the fine print and pick a card that’ll work as hard as you do.

If you’re interested in getting your hands on the best virtual credit card, consider Float’s solution:

- Unlimited physical and virtual corporate cards

- 1% cashback after $25K of spend

- No hidden fees

- Account opening in <24 hours

Written by

All the resources

Industry Insights

Canada’s Crossroads: Why Now is the Moment to Move from Defensive to Intentional Growth

Float's 2025 report on Canadian business shows modest growth, rising costs and shrinking reserves. Find out exactly what the data

Read More

Expense Management

Controller Month-End Close Automation: Streamline Financial Reporting

Controllers, this one's for you. Let's talk about how how automating month-end close helps you move faster without sacrificing accuracy.

Read More

Corporate Cards

Corporate Card Program Implementation: Complete Management Guide

Ready to implement a corporate card program? This is where to start.

Read More