Financial Controls & Compliance

4 Free Online Bookkeeping Courses for Canadian Businesses

Want to level up your bookkeeping? These courses might be the key. Read more to learn what you should be enrolling in.

October 14, 2025

Access to high-quality, no-cost bookkeeping courses helps you build the skills you need to run your business more effectively without spending a dime. With 2025 bringing updated tools, regulations and bookkeeping standards, learning the latest practices is essential to staying current and competitive.

We’ve rounded up four free online bookkeeping courses that’ll help Canadian small business owners and finance teams understand the fundamentals. Plus, we give you a run-down of what’s new in Canadian bookkeeping regulations, 2025 Canadian bookkeeping certification requirements and tips on selecting the right bookkeeping course for your needs.

Why bother with bookkeeping courses?

Training in bookkeeping isn’t the most thrilling part of running a business. But it’s crucial for:

- Keeping your financial records in order

- Making tax time less of a headache

- Understanding your company’s financial health

- Making smarter business decisions

So, let’s dive into these free online bookkeeping courses that’ll transform you from a numbers novice to a balance sheet boss.

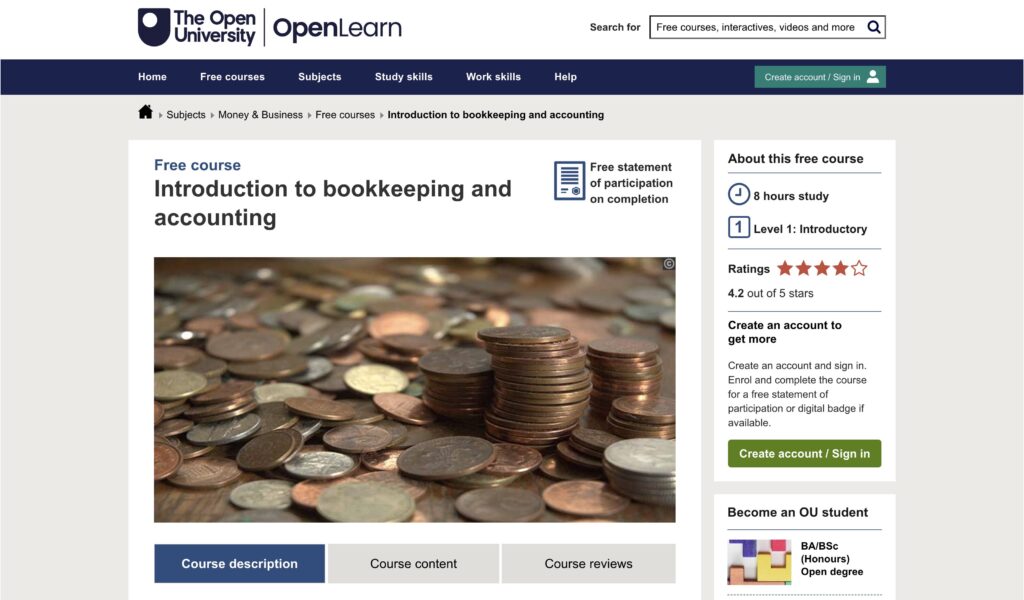

The Open University: Introduction to Bookkeeping and Accounting

Looking to grasp the essentials of bookkeeping and online accounting? The Open University offers a fantastic free online bookkeeping course that’ll set you on the path to financial confidence.

Introduction to Bookkeeping and Accounting is a gem for anyone looking to:

- Master the numerical skills crucial for bookkeeping

- Understand the accounting equation and double-entry bookkeeping

- Learn how to record transactions like a pro

- Create balance sheets and profit & loss accounts

- Balance off-ledger accounts at the end of each accounting period

This course is free and self-paced, making it perfect for people balancing jobs and other responsibilities alongside their learning. You can learn at your own speed, fitting it around your own busy schedule.

This course includes:

- 8 hours of study material

- Beginner-level content

- A free statement of participation upon completion

- Option to earn a digital badge

Whether you’re a small business owner wanting to get a handle on your finances or you’re considering a career change into accounting or bookkeeping, this course provides a solid foundation.

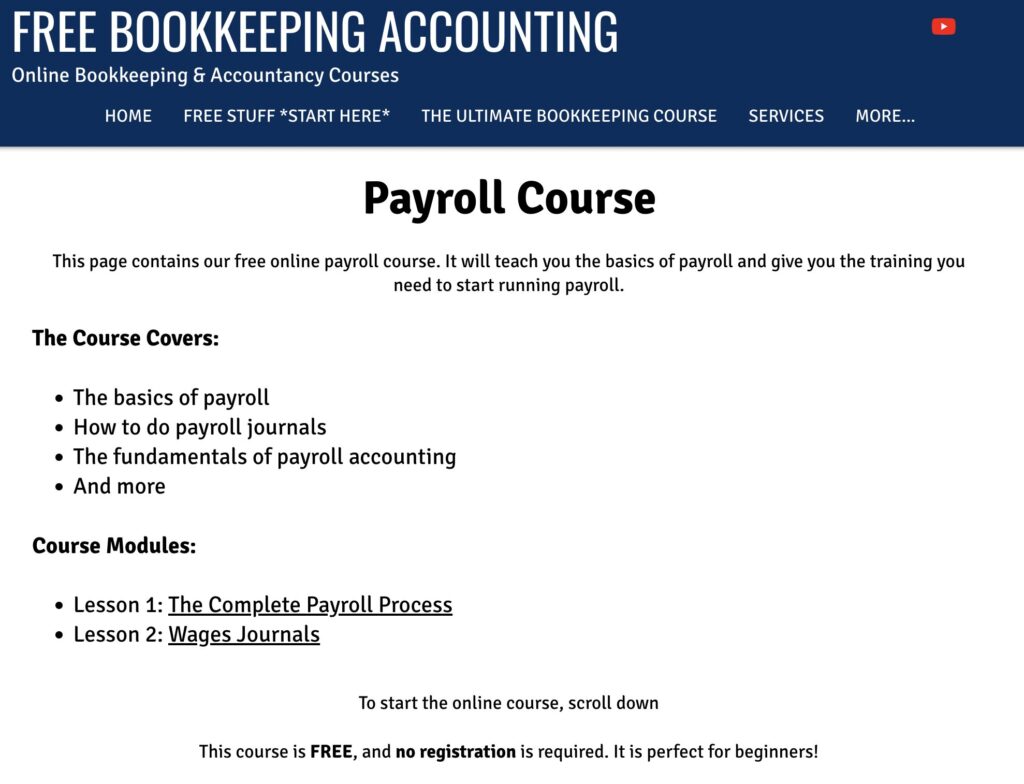

Free Bookkeeping Accounting: Payroll Course

For small business owners looking to get a handle on payroll accounting, FreeBookkeepingAccounting.com is an excellent option. This free online payroll course will have you crunching numbers like a pro in no time.

Run by The Bookkeeping Master, this course covers all the essentials:

- The complete payroll process

- Understanding wages journals

- Fundamentals of payroll accounting

- And much more!

No registration is required. Simply scroll to the lessons and start learning at your own pace. Perfect for beginners, this course breaks down complex concepts into bite-sized, easy-to-digest modules.

Key topics include:

- Decoding payslips and key payroll terms

- The five main steps of the payroll process

- Creating and understanding wages journals

- Accounting for deductions and employer costs

If you’re looking to master payroll for your own business, this free course is an excellent starting point, providing helpful examples of pay slips and wages journals. It’s packed with practical knowledge and clear explanations, and even includes visuals to illustrate key concepts.

edX.org: ACCA’s Free Online Courses

The Association of Chartered Certified Accountants (ACCA) is a globally respected body for professional accountants. They offer a treasure trove of knowledge to help you level up your skills.

Courses cover how to:

- Build a strong foundation with Intro to Bookkeeping and Intermediate Bookkeeping

- Dive into the world of Machine Learning for Finance

- Master the basics with Financial Accounting and Management Accounting courses

- Get tech-savvy with Robotic Process Automation and Cybersecurity for finance pros

The best part? These courses are free to audit, with the option to earn a verified bookkeeping certificate for a small fee if you want to showcase your new skills.

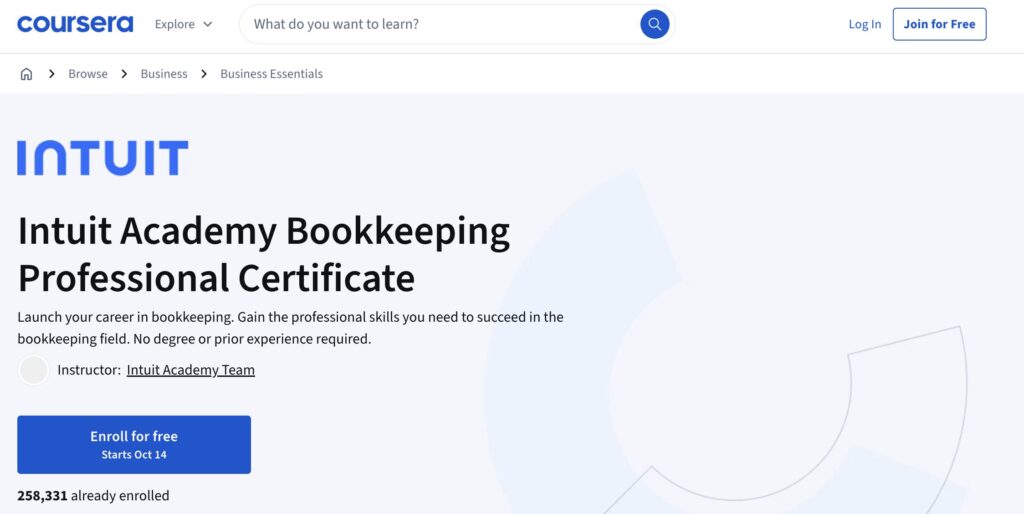

Coursera: Intuit Academy Bookkeeping Professional Certificate

Ready to dive into the world of bookkeeping and level up your financial skills? Head to the Intuit Academy Bookkeeping Online Professional Certificate offered on Coursera! This comprehensive program is designed for both beginners and career-changers.

Here’s why it’s worth your time:

- No prior experience needed—start from scratch and build a solid foundation

- Learn from industry experts at Intuit

- Flexible, self-paced learning—complete in about 2 months at 10 hours per week

- Earn a respected credential to showcase on your LinkedIn profile and resume

What you’ll learn:

- Essential bookkeeping concepts and accounting principles

- Navigating the accounting cycle to produce financial statements

- Analyzing financial data to make smart business decisions

- Hands-on practice with real-world scenarios

2025 Canadian bookkeeping certification requirements

If you’re looking to deepen your knowledge beyond the free bookkeeping courses we’ve shared, or you’re considering bookkeeping as a career avenue, here’s what you need to know in terms of certification requirements:

- Education: To become a professional bookkeeper in Canada, a high school diploma is required. A bachelor’s degree or diploma in bookkeeping, finance or accounting is also required by many organizations that hire bookkeepers.

- Experience: Learning how to bookkeep from a textbook is one thing, but having real-world experience is another. Opt to gain practical experience as a bookkeeper through an internship or entry-level position.

- Certification: In Canada, there is no mandatory certification for bookkeeping. However, there are professional bodies offering bookkeeping certifications that will give you a leg up in the job hunt. Check out the Canadian Bookkeepers Association (CBA) and the National Payroll Institute for their certifications. You’ll need to have a few years of experience as a bookkeeper and pass a written examination to become certified.

- Continuing education: The road to becoming a bookkeeper doesn’t end here. It’s crucial to keep your skills up to date by working in the field, staying in the know when it comes to recent industry developments and taking relevant courses.

Strong bookkeeping skills don’t just open the door to exciting career opportunities—they can also shape the financial future of your business. Earning these certifications equips you with the knowledge to confidently keep accurate, timely records in accounting software like QuickBooks or Xero.

How to choose the right bookkeeping course for your business size

You’ve now got a few great options for everything from free online bookkeeping courses to more in-depth certifications. So, how do you know which one is right for your business? Here are a few tips to make your decision easier.

- Consider the complexity of your business: Do you have a very small business where the main focus is recording transactions to track income and expenses? Or are you dealing with a more complex business where double-entry bookkeeping is required for a more comprehensive financial picture? More complexity = more knowledge needed.

- Determine if you need technical or business skills: If you’re entirely new to bookkeeping, it’s a good idea to start with a bookkeeping course that teaches you the fundamental technical skills. If you already have a background in bookkeeping, you can move on to business skills to learn how to grow your company through effective bookkeeping.

- Review the course content: Free bookkeeping courses in Canada vary in scope. Some provide a general overview of bookkeeping, while others focus on a specific area such as payroll. Certain courses include practical exercises, while others offer advanced skills to enhance your professional credibility. Consider what you need to learn.

- Consider your time commitment and learning style: How much time can you dedicate? Some courses can be completed in a couple of days while others will take months. You’ll also want to consider whether you’ll fare better with a self-paced course or one that follows a specific schedule.

Reviewing these factors will help you decide on the right free bookkeeping course for your needs, based on the size, complexity and requirements of your business.

Free vs. paid bookkeeping courses: ROI analysis

Beyond the four great free (or free with financial aid) courses in this article, there are many other bookkeeping courses available, both free and paid. So, how can you determine whether a free or paid course is right for you?

Instead of focusing on the up-front costs or lack thereof, consider the total return on investment (ROI). Keep in mind that you’ll be investing your time and energy into the course, in addition to your money.

In most cases, free courses offer entry-level or foundational bookkeeping concepts, with short lessons that you can typically complete at your own pace. You’ll cover topics such as double-entry bookkeeping, financial statements, and bookkeeping and accounting software including QuickBooks and Xero. Your investment in these free courses is limited because you’re investing your time and energy rather than your money. However, your return (or knowledge) is fairly significant if you’re new to bookkeeping.

Paid courses typically cover both fundamental and advanced concepts in bookkeeping. Many also offer instructor support, and you may get opportunities to complete practical exercises and get feedback on your work. Your investment in paid courses can range from tens of dollars to thousands of dollars, depending on the course, plus the time and energy required. The return will likely be higher than that of a free course, as you’ll gain more advanced knowledge and potentially also a certification.

So, while a free course has a lower investment and a lower return, and a paid course has a higher investment and a higher return, there is no single right choice. What’s right for your needs depends on your goals for yourself and your business.

Bookkeeping course success stories from Canadian businesses

The best way to tell if a free bookkeeping course in Canada is right for you is to look at reviews and ratings from people who have taken the course. Some of those individuals may be Canadian small business owners or may work in a Canadian small business.

The Open University’s Introduction to Bookkeeping and Accounting course has a rating of 4.2/5 stars based on 235 ratings, with users leaving comments like, “This course is excellent” and “Very good start for beginners. Must do the course.” The positive ratings and reviews show that Canadian small business owners are likely to find success with this course, as it provides a good foundation for learning bookkeeping fundamentals.

The Payroll Course, which The Bookkeeping Master runs, has a rating of 4.7/5 on Trustpilot, based on 27 reviews. The reviews emphasize the level of depth provided, with clear and easy-to-understand instructions, making the learning process enjoyable.

ACCA’s free online courses offered by edX.org boast that 84% of learners with edX have seen professional growth after earning a certificate. Testimonials on their website from real users talk about how edX gives students access to some of the best teachers in the world no matter where they live. Plus, reviewers appreciate that edX’s courses are great for people who have other commitments, such as a business, job or family.

The Intuit Academy Bookkeeping Professional Certificate, offered on Coursera, has garnered 253,631 enrollments and boasts a 4.6/5 star rating with 7,412 reviews. A key testimonial stands out: “I enrolled to broaden my knowledge, and, perhaps, to improve my professional abilities and responsibility. This was an excellent program from start to finish. It was quite informative and provided some great insights into bookkeeping that I was unaware of!” Not only was this student able to gain the knowledge they were seeking, they were also able to get access to information they didn’t know they needed.

Overall, students of all types have found success with these free online bookkeeping courses—whether they’re running a small business, looking to gain new skills or considering becoming a full-time bookkeeper.

What’s new in Canadian bookkeeping for 2025?

While taking a bookkeeping course is a great place to start, learning how to manage the books for your Canadian business isn’t a one-and-done job. It’s a process that requires continuous learning and improvement because the rules that impact your business can change.

If you’re not up to date on all of the new guidelines, you could end up with accounting and bookkeeping issues that leave you scrambling at the last minute—and no one wants to be on the CRA’s bad side.

Here’s an overview of what’s new in Canadian bookkeeping for 2025 that businesses should be aware of:

Transition to online mail

The Canada Revenue Agency has made online mail the default for most business correspondence. To receive notices from the CRA, your business needs to sign up for a My Business Account online.

Canada Pension Plan maximum pensionable earnings and contributions in 2025

This year’s Maximum Pensionable Earnings (YMPE) are $71,300.00.

Capital gains inclusion rate legislation

Good news! The Government of Canada cancelled the proposed hike to the capital gains inclusion rate in an effort to increase investment and entrepreneurship in Canada.

Lifetime Capital Gains Exemption (LCGE)

In 2025, the Lifetime Capital Gains Exemption (LCGE) increased to $1.25 million for qualified small businesses, farming and fishing property. It is available to individual shareholders.

T619 Electronic Transmittal form

The T619 form used to electronically submit tax slips and information returns has been updated for 2025. Fields have been added, modified and removed. The new version has been accepted since January 13, 2025, and should also be used for prior-year information returns.

Information return type

As of January 2025, all tax returns filed in the same submission must be the same information return type. For example, if you file a T4 information return type, all returns in that submission must be a T4 information return type. You can file for multiple business numbers at the same time as long as they are the same information return type. If not, the file will be marked invalid and rejected.

Online validations

If you’re using the CRA’s Web Forms or Internet File Transfer applications, keep in mind that new online validations, such as for file sizes and formats, are now in place to ensure all files are correct before they’re submitted.

These are just some of the changes Canadian small business owners need to be aware of this year. Be sure you make the necessary adjustments in your accounting software to make month-end and tax filing run smoothly.

Float’s expense management platform automatically captures and categorizes taxes according to CRA rules, helping teams stay compliant while reducing manual data entry.

Make expense management even easier

Streamline your business spending with automation tools built right into Float.

FAQ

Your bookkeeping course questions answered

Most of these courses are designed for beginners, but check the individual descriptions for any prerequisites.

Yes, some of these courses offer fairly sophisticated bookkeeping training and offer certificates upon program completion.

This varies by course. Some may offer ongoing access, while others might have time limits.

These free courses are great for personal development, but may not count towards official certifications. Check with professional bodies for accredited programs.

Most courses suggest 3 to 5 hours per week, but the beauty of bookkeeping training online is its flexibility!

Ready to balance those books?

Good bookkeeping is the foundation of a healthy business. From mastering the basics of the accounting cycle to tackling complex financial analysis to learning common tools like QuickBooks and Xero, there’s a course here for everyone. So, grab a cup of coffee, fire up your computer and get ready to dive into the world of balance sheets. Your future financially-savvy self will thank you!

Once you’ve mastered the basics of bookkeeping, the right financial management tools can help automate and scale your processes.

Float is Canada’s complete business finance platform, combining corporate cards, reimbursements, bill payments and high-yield business accounts in one place. Unlike US-based tools, Float is purpose-built for Canadian businesses, with local compliance, CAD/USD multi-currency support and integrations that give finance teams full visibility into every transaction in real time. The platform also integrates directly with accounting software like QuickBooks, Xero and NetSuite to automatically sync receipts, taxes and GL coding, helping Canadian finance teams close their books up to 8x faster and stay CRA-compliant.

To learn how automation tools like Float can simplify bookkeeping and financial operations for Canadian teams, visit Float’s Industry Insights content.

Written by

All the resources

Industry Insights

Canada’s Crossroads: Why Now is the Moment to Move from Defensive to Intentional Growth

Float's 2025 report on Canadian business shows modest growth, rising costs and shrinking reserves. Find out exactly what the data

Read More

Expense Management

Controller Month-End Close Automation: Streamline Financial Reporting

Controllers, this one's for you. Let's talk about how how automating month-end close helps you move faster without sacrificing accuracy.

Read More

Corporate Cards

Corporate Card Program Implementation: Complete Management Guide

Ready to implement a corporate card program? This is where to start.

Read More