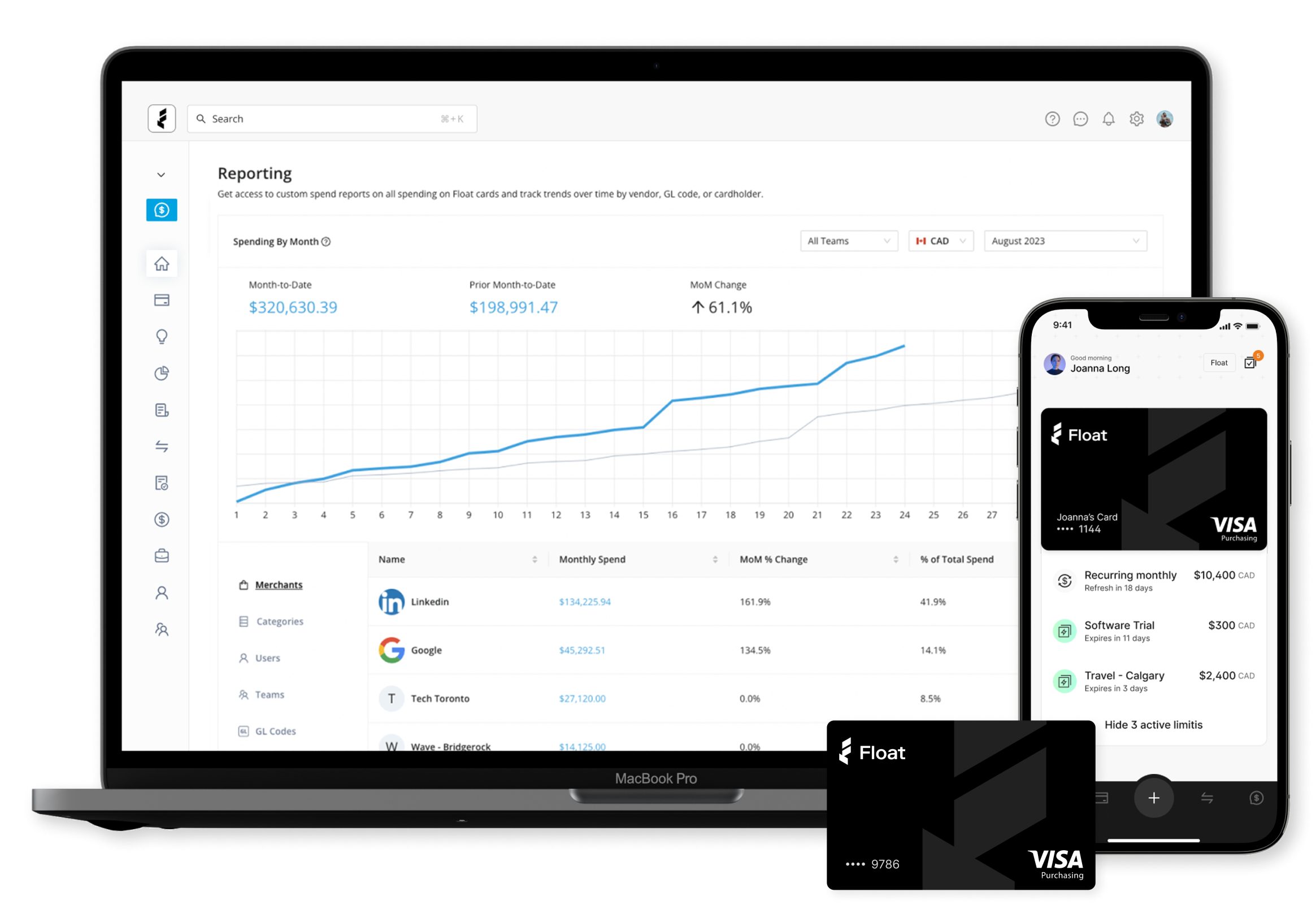

Spend Management

Float vs. Ramp: What’s Best for Canadian Businesses?

Unlike Ramp, Float offers built-for-Canada accounting automations, flexible payments and a local, world-class support team that understands your Canadian business.

Stay CRA-ready with Canadian compliance expertise, plush automations for tax codes, merchants and more

Earn up to 4% interest on both your CAD and USD balances

All-Canadian support team in both English and French

Trusted by thousands of leading Canadian companies.†

Float vs. Ramp: Canadian Market Comparison 2025

See how Float’s functionality outperforms Ramp for Canadian entities.

| Unlimited virtual and physical cards in CAD and USD* | ||

| Employees can hold physical cards in multiple currencies | ||

| Individual card limits and controls | ||

| Pre-funded or charge card options | ||

| Supports USD credit without a US-domiciled account | ||

| Up to 4% interest on CAD and USD cash balances | ||

| Funds held with a CDIC-member banks and eligible for CDIC protection up to applicable limits | ||

| Automated receipt capture and matching | ||

| Canadian accounting automations, localized tax codes (GST, HST, etc.) | ||

| Canadian accounting integrations (QBO, Xero, NetSuite) | US tax logic only | |

| Bilingual support (EN/FR) with Bill 96 compliance | ||

| Free EFT and ACH transfers, in both CAD and USD | ||

| FINTRAC-registered Money Services Business | ||

| Registered Payment Service Provider by Bank of Canada | ||

| Solutions that work for Canadian companies without a US entity |

*For Professional plan members. Essential members get unlimited virtual cards and 20 physical cards.

See why 5,000+ Canadian companies trust Float.

Canadian market advantages: Float vs. Ramp

Float is built for the realities of Canadian finance, from tax codes to currency flexibility.

US spend platforms often fall short in Canada. Float is the only solution that fully supports Canadian compliance, currency and banking systems, helping finance teams save time, stay audit-ready and operate confidently on both sides of the border.

Canadian compliance, guaranteed

Manage your money right here in Canada. Float is registered with FINTRAC and an official Payment Service Provider recognized by the Bank of Canada, as well as offering CDIC insurance.

Dual-currency freedom

Spend in both CAD and USD with a single platform. Avoid FX markups, simplify reconciliation and pay vendors like a local at home or in the US.

Tax and accounting alignment

Connect seamlessly to Canadian QuickBooks, Xero and NetSuite accounts with multi-part tax tracking—no manual GST rework or data loss.

Local support that gets you

Our Canadian-based team understands your regulatory environment, your banking systems and how Canadian finance teams actually operate.

Integration capabilities: Float vs. Ramp comparison

Seamless integrations that speak the language of Canadian finance.

Float integrates seamlessly with QuickBooks Online, Xero and NetSuite, automating Canadian tax codes and multi-part GST/HST tracking. Ramp’s integrations, designed for US entities, often require manual adjustments and lack Canadian compliance logic.

Pricing analysis: Float vs. Ramp total cost of ownership

See what you really save when you choose a platform made for Canada.

Both Float and Ramp offer free and paid tiers, but the similarities stop there. Ramp’s USD-based model adds hidden costs for Canadian teams—from FX fees and manual tax work to lost interest on CAD balances. Float keeps your costs transparent and your cash working harder.

Float

Transparent pricing in CAD, starting at $0/user/mo

Earn up to 4% interest on CAD + USD balances

1% cashback on all spend over $25,000

Automated GST/HST compliance saves hours every month

Active-user pricing ensures you only pay for what you use

Ramp

Enterprise-level pricing may apply: $15+ USD with annual billing

Interest only on USD balances (2.25–4.12%)

Standard credit card FX fees on every CAD transaction

Manual GST/HST tracking for Canadian users

No yield on CAD cash

Float helps Canadian businesses save up to 7% annually through better FX rates, interest earnings and automation.

Purpose-built for Canadian businesses. No US roadblocks included.

US-first spend tools create hidden friction for Canadian teams, from missing tax codes to limited currency support to restrictions on Canadian entities. Float removes all of that with spend management, cards and integrations built for Canadian operations from day one.

No US entity requirements

Many US platforms require a US entity or address before issuing cards, adding legal and administrative overhead that Canadian teams shouldn’t have to deal with. Float gives Canadian companies direct access to corporate cards, controls and audit-ready workflows without cross-border setup or workarounds.

CAD + USD cards for every employee

Canadian teams typically spend in both CAD and USD. But US solutions restrict employees to a single currency, forcing costly FX conversions. Float lets you issue both CAD and USD cards instantly to any employee, eliminating FX costs and letting teams manage everything in one simple, intuitive platform.

Built for GST/HST/PST/QST

Since US solutions don’t support Canadian tax codes or localized NetSuite, QBO and Xero setups, you’re stuck with manual reconciliations and compliance risk. Float supports multi-part Canadian tax codes out of the box and syncs cleanly to your ERP, helping teams close the books in hours instead of days.

See how Canadian companies are saving time and money with Float.

Save 7% of your total spend

Float is the only platform that helps companies save 7% of their total spend from time savings at month-end to productivity gains across the company and earnings that are anything but a bank.

Enjoy 1% cashback on card spend, up to 4% interest on cash balances, and lower FX fees.

Why Blue J chose Float’s smart corporate cards

“Before Float, we didn’t have clear visibility over our financials until month end rolled around. I recall getting these big Visa statements with all these charges and it was incredibly difficult to keep track of.”

Suzanne Gratch

VP Finance

*Trademark of Visa International Service Association and used under licence by Peoples Trust Company.