Product Education

Spend Less with Float’s Savings Insights

Get monthly suggestions on how to cut waste and save money on your company’s software spending.

May 1, 2023

As your business grows, managing your software subscriptions becomes increasingly challenging. Extra seats and duplicate subscriptions across teams can add-up quickly without anyone noticing, and it’s costing businesses.

Software subscriptions tend to take up a large chunk of budgets. Whether it’s Zoom, Google Workspace, or Amazon Web Services, Canadian companies have become increasingly cloud-based with remote teams.

In fact, we spoke to businesses across Canada about their spending and where they’re actively trying to reduce costs, and software continues to be the top expenditure finance teams want to tackle.

That’s why our team is excited to release Savings Insights, the latest feature in Float’s real-time Reporting page designed to help you spend less.

What are Savings Insights?

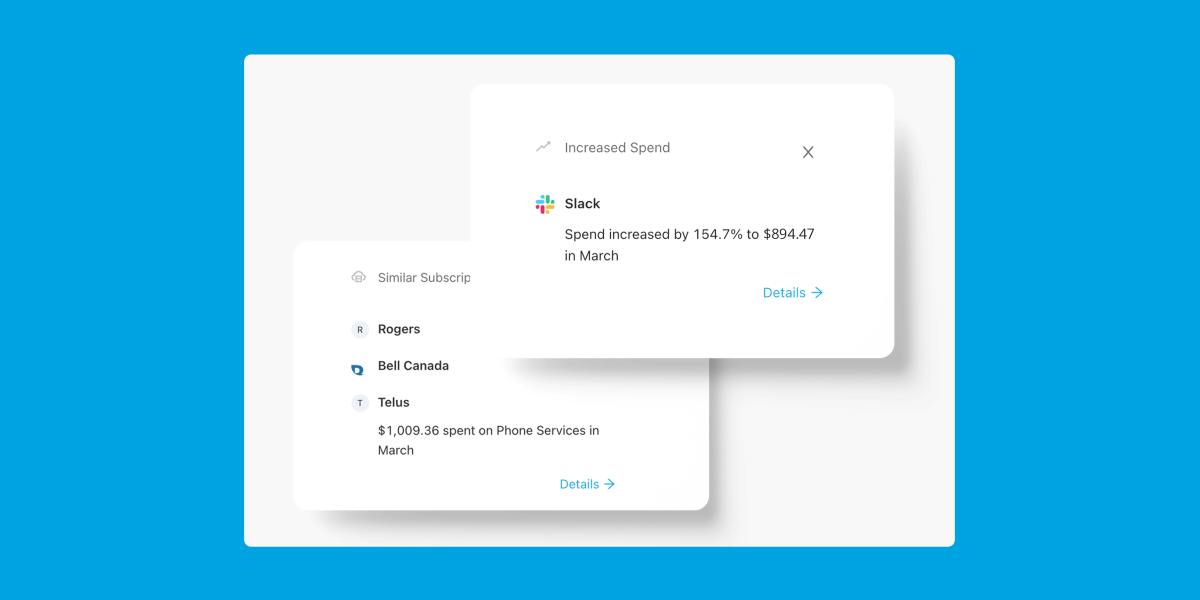

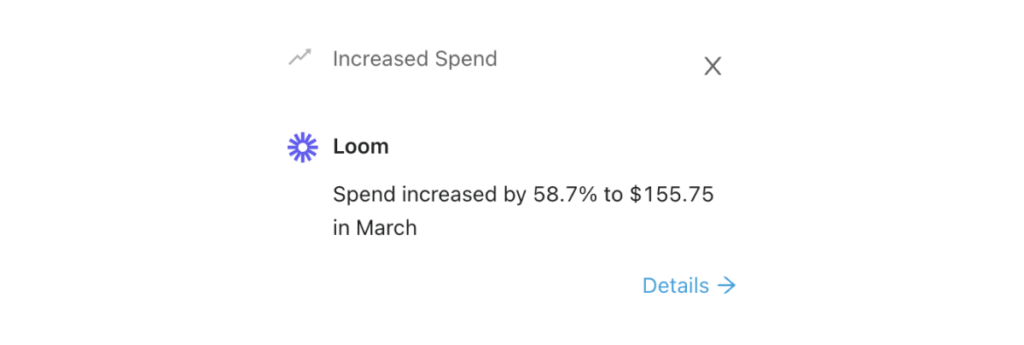

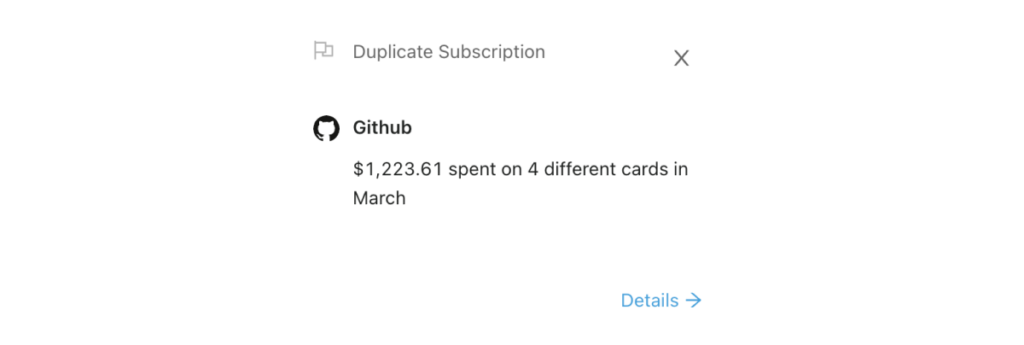

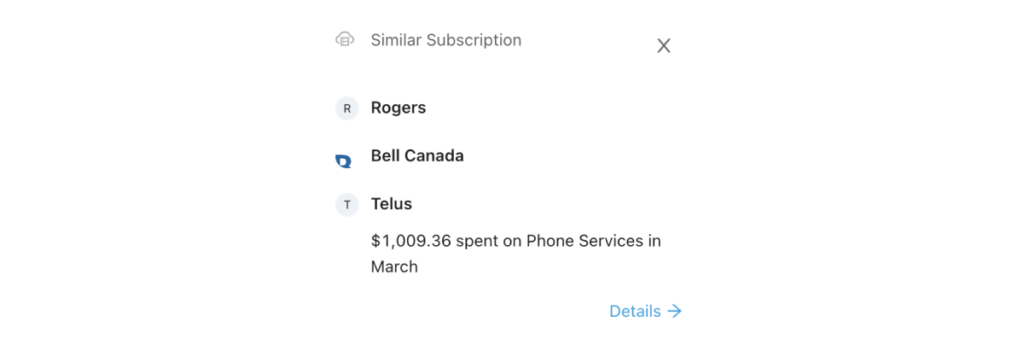

Savings Insights is a powerful new tool that gives you monthly suggestions on how to save money on your company’s software spending. Our intelligent software scans for Increased Spend, Duplicate Subscriptions, and Similar Subscriptions, and provides you with valuable insights to reduce your costs.

Spot Significant Increases in Spend

Increased Spend Insights is designed to notify you of any unexpected billing increases, large jumps in tool usage, or potential double-charges. If your monthly spend on a particular software tool suddenly increases by a significant amount, Float will flag it as an Increased Spend Insight so you can investigate and take action if necessary to keep your costs low.

Find Savings Across Teams

Duplicate Subscriptions identifies any software subscriptions that are duplicated across two or more employees. Duplicate subscriptions can often be consolidated into one account with a larger discount, or can be eliminated altogether to save costs.

Eliminate Waste and Streamline Subscriptions

Similar Subscriptions identifies software tools that provide overlapping features. If you have two or more software subscriptions that perform similar functions, Float will flag them as Similar Subscriptions giving you the opportunity to cancel one or more of these subscriptions altogether, which can lead to significant cost savings over time.

Float’s Savings Insights feature is designed to help businesses optimize their software spending by identifying potential cost-saving opportunities. By providing actionable insights into your company’s software expenses, Float can help you save money, streamline your subscriptions, and increase your overall efficiency.

—

Already a Professional Float customer? Log in today and start saving by going to the Reporting page. You can mark an Insight as actioned for that month only to continue to get updates on that merchant in subsequent months, or mute an Insight forever if you’re comfortable with the spending and don’t want to receive future alerts. Savings Insights are automatically enabled for all Professional Plan customers and are located at the bottom of the Reporting page – learn more about Savings Insights at our Help Centre here.

Not a Float customer (yet)? To improve the way you manage your company’s subscriptions, book a demo with us today! Our team is happy to walk you through our smart corporate cards and spend management software.

Written by

All the resources

Expense Management

How Do You Handle Employee Reimbursements Efficiently?

Learn how to simplify employee reimbursements with efficient, scalable strategies for small businesses and growing finance teams.

Read More

Corporate Cards

Amex Global Platinum Dollar Card Alternatives for Canadian Businesses in 2026

Canadian businesses are dealing with the discontinuation of the Amex Platinum Global Dollar Card and looking for a replacement card.

Read More

Expense Management

CDIC Insurance for Canadian Business Banking: Complete Protection Guide

Uncertainty about where your money sits—or whether it’s protected—is the last thing any business needs. That’s why understanding CDIC insurance

Read More