Product Education

Introducing Merchant Controls

Issue cards to employees worry-free by limiting their transactions to approved merchant categories.

February 7, 2023

Our team is excited to release Merchant Controls, the latest feature in Float’s lineup of intelligent card controls designed to help finance teams save on company spending. Merchant Controls give the ability to restrict transactions on Float cards to approved merchant categories, ensuring that funds are being used for the intended purposes only.

What are merchant categories?

Merchant categories are a way of categorizing businesses according to the type of goods or services they provide. They are typically used by credit card companies to track and categorize the types of purchases made on credit cards and to determine how to classify those transactions for rewards programs and spending reports. Some common merchant categories include:

- Alcohol and bars

- Airlines

- Gas and charging

- Restaurants

- Lodging

What are Float’s Merchant Controls?

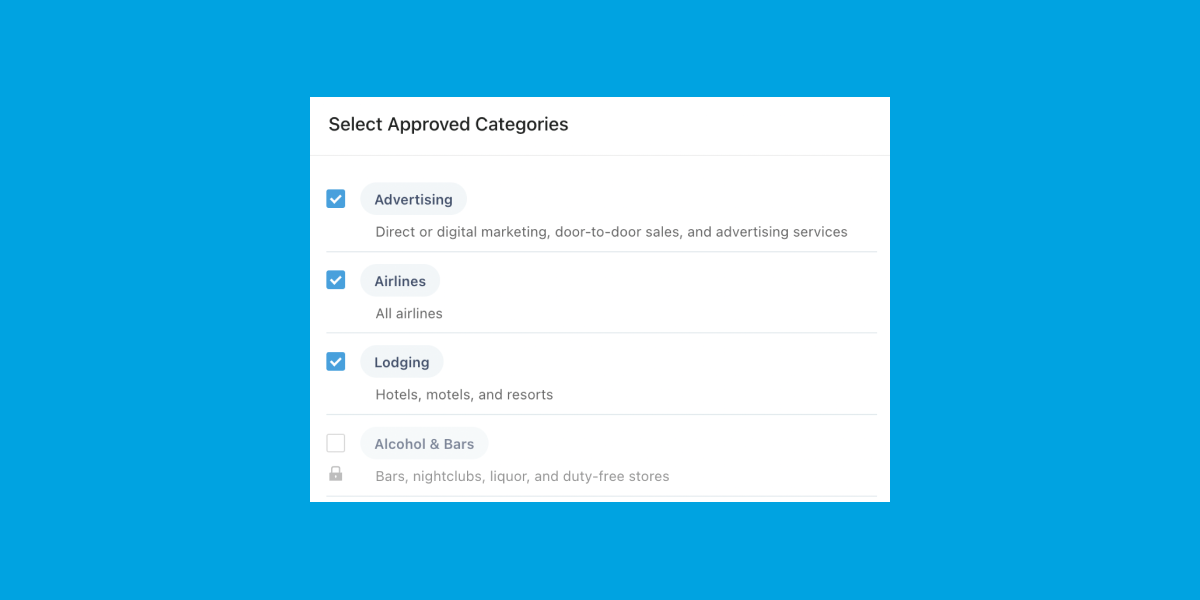

With Merchant Controls, finance teams can limit card transactions to specific merchant categories, such as advertising, airlines, or gas. This ensures that employees’ corporate card purchases align with the company’s spending policies and reduces the risk of fraudulent or unauthorized spending.

Merchant Controls are easy to set up and can be customized for each Float Card. When creating a new Float Card, finance admins can simply add the merchant categories to include or exclude from the card’s transactions. For existing cards, click “Edit Card” to add or edit merchant categories.

If a Spender attempts to make a purchase from an unapproved merchant category, Float will decline the transaction and inform the cardholder.

Learn more about setting up Merchant Controls in our video below, or check out our Help Centre’s step-by-step guide here.

—

At Float, we understand the importance of managing corporate spending and the challenges that finance teams face in keeping track of expenses. That’s why we developed Merchant Controls to give finance teams the control they need to manage and monitor spending effectively directly with Float Cards.

If you’re interested in learning more about Float’s Merchant Controls, or any of our other features, get in touch today or book a demo. We’re here to help you simplify your company and team’s spending.

Written by

All the resources

Industry Insights

Canada’s Crossroads: Why Now is the Moment to Move from Defensive to Intentional Growth

Float's 2025 report on Canadian business shows modest growth, rising costs and shrinking reserves. Find out exactly what the data

Read More

Expense Management

Controller Month-End Close Automation: Streamline Financial Reporting

Controllers, this one's for you. Let's talk about how how automating month-end close helps you move faster without sacrificing accuracy.

Read More

Corporate Cards

Corporate Card Program Implementation: Complete Management Guide

Ready to implement a corporate card program? This is where to start.

Read More