Expense Management

How Float makes expense reports a thing of the past

Wondering how to submit your expense reports in Float? Hint: You don’t! 😉 We’ve got something better and more efficient for you.

October 11, 2022

Every business in any industry knows the struggle of creating and managing expense reports – whether it’s for travel, marketing, or even simple daily business purchases. This dreaded process is far too tedious and difficult to keep track of, especially if your team is rapidly growing.

At Float, we consider this the old way of doing things. It goes a little something like this. ⬇️

💳 An employee makes a purchase

👨💻 Employee fills out an excel spreadsheet

🧾 Employee scans and emails their receipts (if they still have them)

⏳ Employee waits to be reimbursed

But now, we’re introducing a new way: The Float way 🤩

With Float, you can wave goodbye to submitting expense reports altogether. Our software makes it quick and easy for employees to record transaction details of business purchases in real time. We’ve eliminated all the paperwork, long waits for reimbursements, and the back and forth required between employees and the finance team. You’re welcome in advance! 🎉

Along with our software, Float’s smart corporate cards give employees the option to submit their receipts easily and effortlessly! 👍🏼 No spreadsheets to manage and no reports to file!

Every time an employee makes a purchase on their Float card, they’ll be automatically prompted to submit a receipt – that’s it! 💪🏼 There’s no need to log into Float or download another app. Once your receipt is submitted, we’ll automatically match it to the transaction on your card and voila! 🤌🏼

Float allows spenders to submit their receipts in three simple ways:

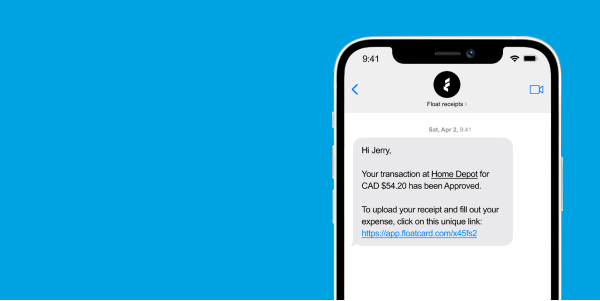

1. Upload receipt via Float’s quick link 📤

After making a purchase on a Float card, we’ll text or email spenders a custom quick link to upload their receipt. From this link, they may also be asked to provide purchase details like expense categories and a description – depending on the company’s specific expense policies.

2. Text a photo of the receipt 🤳

Spenders can simply respond to Float’s SMS transaction confirmation with a photo of their receipt! To set this up, they must add their mobile number to their Float profile on the “Settings” page. Notifications must also have been enabled for the company by an admin.

3. Forward your email receipt 📨

All receipts delivered to the spender’s inbox can be forwarded directly to Float by using a personalized receipt forwarding address. Companies can also set up Float’s auto-forwarding feature to automatically send receipts from subscriptions or advertising platforms that get delivered via email. Check out this Float article for instructions on how to find your personalized receipt forwarding address and set up the auto-forwarding function.

Float matches receipts to transactions so you don’t have to 🧾

Once your receipt is submitted, we’ll automatically match it to the transaction for you. There’s no need to log into Float or for the Finance team to manually reconcile hundreds of transactions at month-end.

While we always recommend sending in your receipt as soon as a transaction is made, Float is able to automatically match receipts to transactions even if they’re submitted weeks after a purchase is made. Spenders and managers can also log into Float at their own convenience to view their Receipts Inbox and match receipts to transactions manually. And, if there happens to be a receipt that we can’t match to a transaction, you can easily view them in the “Not Matched” tab.

It’s time to wave goodbye to expense reports and submit your receipts effortlessly with Float. 👋🏼

Written by

All the resources

Industry Insights

Canada’s Crossroads: Why Now is the Moment to Move from Defensive to Intentional Growth

Float's 2025 report on Canadian business shows modest growth, rising costs and shrinking reserves. Find out exactly what the data

Read More

Expense Management

Controller Month-End Close Automation: Streamline Financial Reporting

Controllers, this one's for you. Let's talk about how how automating month-end close helps you move faster without sacrificing accuracy.

Read More

Corporate Cards

Corporate Card Program Implementation: Complete Management Guide

Ready to implement a corporate card program? This is where to start.

Read More