Expense Management

Modern Expense Policy Guide

Understand how to revolutionize your business spending by tapping into the benefits of a modern company expense policy. With help from real-world examples, you’ll learn the types and key components of a great travel and expense policy—and discover how to streamline your expense management process with the help of automation.

July 26, 2022

A company expense policy is critical for staying on budget, preventing expense fraud and establishing reimbursement processes. At most companies, however, these important documents for an overhaul. Here’s why.

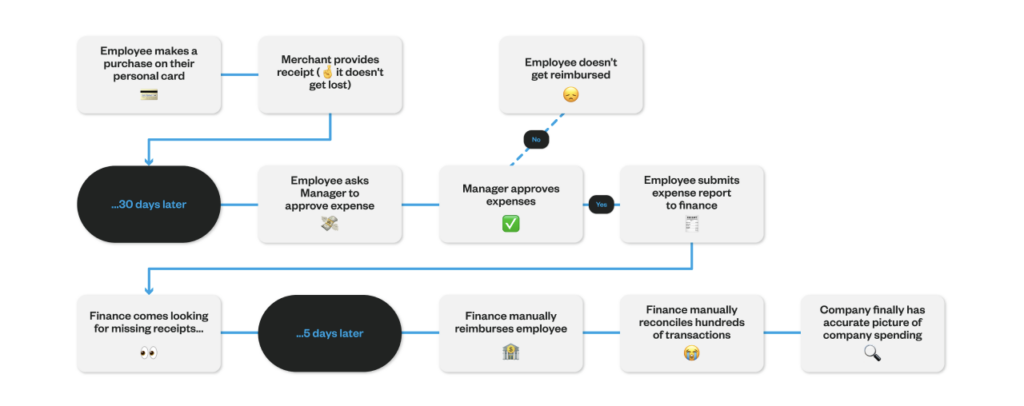

Traditional company expense policies often use unclear wording that’s laden with financial jargon. They can also be tied into complex manual processes that rely on email or even interoffice mail, involve multiple stakeholders and result in meandering paper trails.

For employers and finance departments, these processes come with reduced insight into the company’s current financial standing—and an increased risk of fraud. According to a recent report by the Association of Certified Fraud Examiners (ACFE), companies lose an average of $251,000—and those massive losses can go undetected for up to 18 months.

Traditional reimbursement policies also include a lot of hidden administrative work. Recent reports show that on average, 19% of expense reports contain errors, which costs a business time and money to correct. In fact, annual processing costs can exceed $500,000. That includes the costs of correcting errors—a task that the average business spends more than a staggering 3,000 hours on every year.

But employers aren’t the only ones who lose time and money due to inefficient expense policies. According to Forbes, 2 in 5 employees have had their cash flow impacted by lengthy and inefficient reimbursement processes, which can significantly impact morale, leading to higher employee churn and lower productivity. All of these concerns can be addressed by creating a modern expense policy that’s designed to help companies maintain control over budgets while also driving growth.

But what does a modern expense policy look like?

In this article, we’ll answer key questions like:

- What is an expense policy?

- What are the benefits of a modern expense policy?

- What types of expense policies exist?

- What are the key components of a modern expense policy?

- How do I create a modern expense policy?

What are the best practices for enforcing company expense policies?

What is an expense policy?

A company expense policy (also known as a reimbursement policy) is a set of clear expense-related guidelines created by the business owner, operator or finance team. The policy outlines which business expenses are eligible for reimbursement, how employees should submit those expenses for approval and the steps to resolve disputes. This kind of policy ensures consistency, transparency and compliance in expense management.

What are the benefits of creating a company expense policy?

When a strong expense policy is in place, everyone wins.

For companies, the benefits can include:

- Efficiently controlled company-wide spending

- More accurate spending forecasts

- Standardized rules for expense management

- Fewer non-compliant expenses and a reduced risk of fraud

- Less administration time spent evaluating spend requests

For employees, the advantages are:

- Access to clear information on what is reimbursable and what is not, so they can make informed decisions quickly

- No unnecessary reimbursement delays or refusals

- Reduced administrative workload thanks to a clear and streamlined reimbursement process

- Increased morale and reduced frustration, improving general engagement and satisfaction

Overall, an expense policy helps finance departments follow expense management best practices, improves transparency and clarifies expectations.

Key expense policy components

Although company needs and processes differ, several key components appear in most expense reimbursement policies. These include:

Expense categories

These outline the different types of expenses that employees can incur, so they don’t accidentally make a business purchase they can’t be reimbursed for. Categories may include travel, meals, accommodations, or office supplies. (That means Brian’s daily latte habit probably isn’t making the cut).

Spending limits

Each expense category should include clear limits that identify the maximum amount employees can spend without additional approvals. This helps prevent anyone from accidentally over-spending on business expenses.

Reporting and approval

Good expense policies clearly outline the steps employees must follow for expense pre-approval and reporting. This includes access to any required documentation.

Documentation requirements

Listing any supporting documents (like receipts or invoices) that employees will need to submit with their expense reports is a must. When this information isn’t outlined up-front, people are more likely to misplace necessary documents, creating friction when it’s time to submit their report.

Reimbursement procedures

This is a step-by-step outline explaining the process employees need to follow when submitting expense reports. This section also includes information on required forms or software systems.

Non-reimbursable expenses

This component clearly details expenses that are not eligible for reimbursement—for instance, personal expenses, fines or alcohol. (That “team building” round of margaritas won’t be going on the company tab).

Travel and accommodation guidelines

Like many employers, your business may have preferred provider arrangements with flight companies, hotels, rental cars and more. These guidelines provide these details, plus any additional travel-related policies that may impact reimbursement.

Expense audit and compliance

This section explains how expense reports are audited, and explains what can (or will) happen if expenses or reports do not comply with the expense policy.

How to write a company expense policy

Now that you understand the basics of company expense policies, here’s a step-by-step process (with real-world expense policy examples) you can follow to build one of your own.

Once you’ve had time to think through all the components you want to include in your expense policy, we’ve got you covered with our free Expense Policy Template.

Step 1: Gather information

Good expense policies are carefully designed to meet the needs of a company’s culture, industry, and existing processes. That means before you begin building your policy, you’ll need to do a baseline assessment. Take time to consider:

- How your budget will impact your expense policy and vice versa

- Whether or not there are any specific stipulations you’d like to add to support your mission, values and culture

- The needs and desires of your employees (Do they need quick reimbursements? Flexible travel options?)

Remember to include other stakeholders in these considerations. Talk to your company’s financial experts and the employees who are most likely to use this policy to gain a more holistic understanding of how to meet everyone’s needs—and any barriers that might be in the way.

Example: You run a tech start-up where employees travel frequently for networking events. In this scenario, you may want to streamline the expense process by allowing staff to book economy flights without pre-approvals, or fast-tracking reimbursements with automated reimbursement solutions.

Step 2: Define eligible expenses

Every company expense policy needs to explain which expenses are eligible for reimbursement. It should also describe the difference between personal and business expenses so that if an expense is challenged, you have clear wording to fall back on.

At this stage, you’ll also want to decide on other spending parameters, like maximum spending per expense category, or preferred hotel requirements.

Example: You own a travel agency and want to encourage your employees to explore the world so they’re more informed when speaking to clients. You decide to build personal travel expenses into a travel expense policy—but you limit that category to $1,500 per year and stipulate that travellers may only stay at select hotels.

Step 3: Define required documentation

When it comes to reimbursing expenses, it’s critical to collect documentation that supports your employee’s expense report. Consider how you’ve defined eligible expenses, then decide what kind of documentation you’ll need to determine whether or not your spending parameters have been satisfied.

Example: You work for a marketing agency that frequently does business over dinner. If your eligible expenses exclude alcohol and limit meal reimbursements to an average of $100 per attendee, you’ll need to request employees provide receipts that show the name of the restaurant, the date and an itemized list of menu items. You may also want to ask for a brief note explaining the purpose of the dinner and a list of attendees.

Step 4: Develop a pre-approval process

Pre-approvals are an important way to ensure compliance and avoid budgetary issues. However, they can also create barriers in cultures or industries where travel and entertainment is frequent and necessary.

Before you begin this process, consider the needs of your employees and balance those with any budgetary constraints. Then develop a clear process that allows enough flexibility for staff to do their job well, but also reduces budgetary risks.

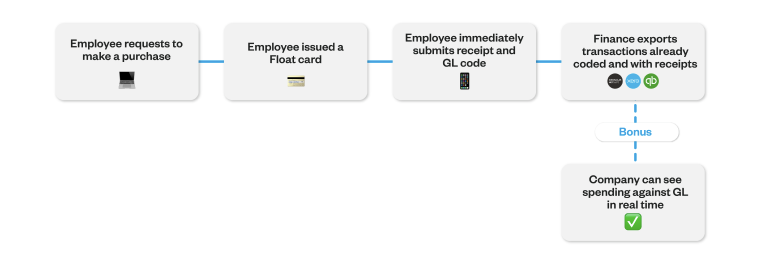

Turnaround time is a factor to consider as well. If your business receives a last-minute opportunity, you don’t want to bog your employees down with a lengthy pre-approvals process—so consider ways to automate your process for a more streamlined experience. With Float, for example, employees with virtual cards can request top-ups or temporary limit increases. These requests are routed to managers, who get an alert to approve with the tap of a button.

Example: You run a construction company that often needs quick access to specialized equipment like scaffolding. To avoid delays due to pre-approval processing, you decide to allow supervisors to approve rentals under $2,000 without gaining pre-approval.

Step 5: Design your reimbursement process

First, decide if you’d like to streamline the process for employees and reduce administrative overhead with an automated expense solution. If so, you’ll need to choose the right solution for your business before you begin designing this process (trust us, it’ll save you plenty of time later).

Once you decide whether or not your process will be automated or manual (or some combination of both), you’ll need to create a clearly written set of step-by-step instructions for reimbursement. Remember to:

- Include links to any templates or software that employees might need to submit their expense reports

- Decide who will be responsible for managing the process and include information on how to contact them

- Choose an expense submission deadline to avoid a large pile-up of unexpected submissions that could delay month end close

Example: You work for a manufacturing company that frequently sends employees to trade shows. Staff have previously expressed frustration with slow reimbursements, so you choose to build your new reimbursement process around an automated expense management system that integrates with your accounting software (to ensure budgetary compliance).

Next, you add a step-by-step guide to submitting trade show expenses to your travel expense policy, along with clear instructions on how to use the new software. You make sure you assign a dedicated contact person for troubleshooting and set a monthly deadline for expense reports.

Best practices for ensuring expense policy compliance

Documenting your company expense policy is an important first step (we hope those expense policy examples were helpful!)—but it’s just as critical to develop a framework to ensure that everyone follows the rules.

Here’s how automated expense reimbursement solutions can help protect your budget—without stifling growth and innovation.

Set spending boundaries

Accidental overspending can easily happen, whether an employee loses track of their menu choices or simply misreads the expense policy. Fortunately, a good automated reimbursement solution will include an option to limit spending at the credit card level.

Add spending guardrails to enforce spending boundaries

Customize your automated reimbursement solution so that it automatically checks for expense compliance based on your company’s specific spending guidelines. For example, if an employee attempts to make a purchase that exceeds a category limit or is outside an approved category all together, that transaction won’t go through.

Encourage timely expense reports

Program your automated reimbursement solution so that it sends reminders to prompt cardholders to upload receipts and expense reports before your established deadline.

Balance control and growth

Maintain visibility and control over company-wide spending without creating unnecessary barriers for employees by using an automated reimbursement solution to:

- Set up customized, multi-level approval processes that streamline the pre-approval process (while maintaining an audit trail)

- Automatically collect receipts and GL codes by setting up policies that let you define the information employees need to submit with each transaction (like receipts and GL codes), and pause cards when they aren’t received

- Protect your company from unauthorized spends by implementing card controls that restrict spending at certain merchant categories and incorporate customized limits

- Access real-time reporting on company spending, with insights that outline spending at a granular level

Ready to start designing your company expense policy?

Try our Expense Policy Template today.

Written by

All the resources

Cash Flow Optimization

Capital Efficiency: Getting More from Your Funds

See what Brian Didsbury, CPA and Senior Manager/Controller at LiveCA, says about capital efficiency and learn a few financial concepts

Read More

Cash Flow Optimization

Payment Optimization: Strategies to Improve Cash Flow

Profit on paper doesn’t mean much if your cash is tied up in late customer payments or drained by supplier

Read More

Cash Flow Optimization

7 Best Business Accounts in Canada for 2025

Finding the best business account in Canada isn’t as simple as walking into your nearest branch. That's where this guide

Read More