All in on Canada.

Corporate cards, bill payments, expense management and up to 4% interest to help your business grow.

By submitting your email, you agree to opt in to marketing emails.

Trusted by thousands of leading Canadian companies.†

“Float has been a game changer.”

Katherine Lei, Director of Finance

See how Impact Kitchen’s finance team saves 100+ hours a year and runs 7 restaurants using Float.

Your complete business finance platform.

Access the right financial software and

services for your business, all with Float.

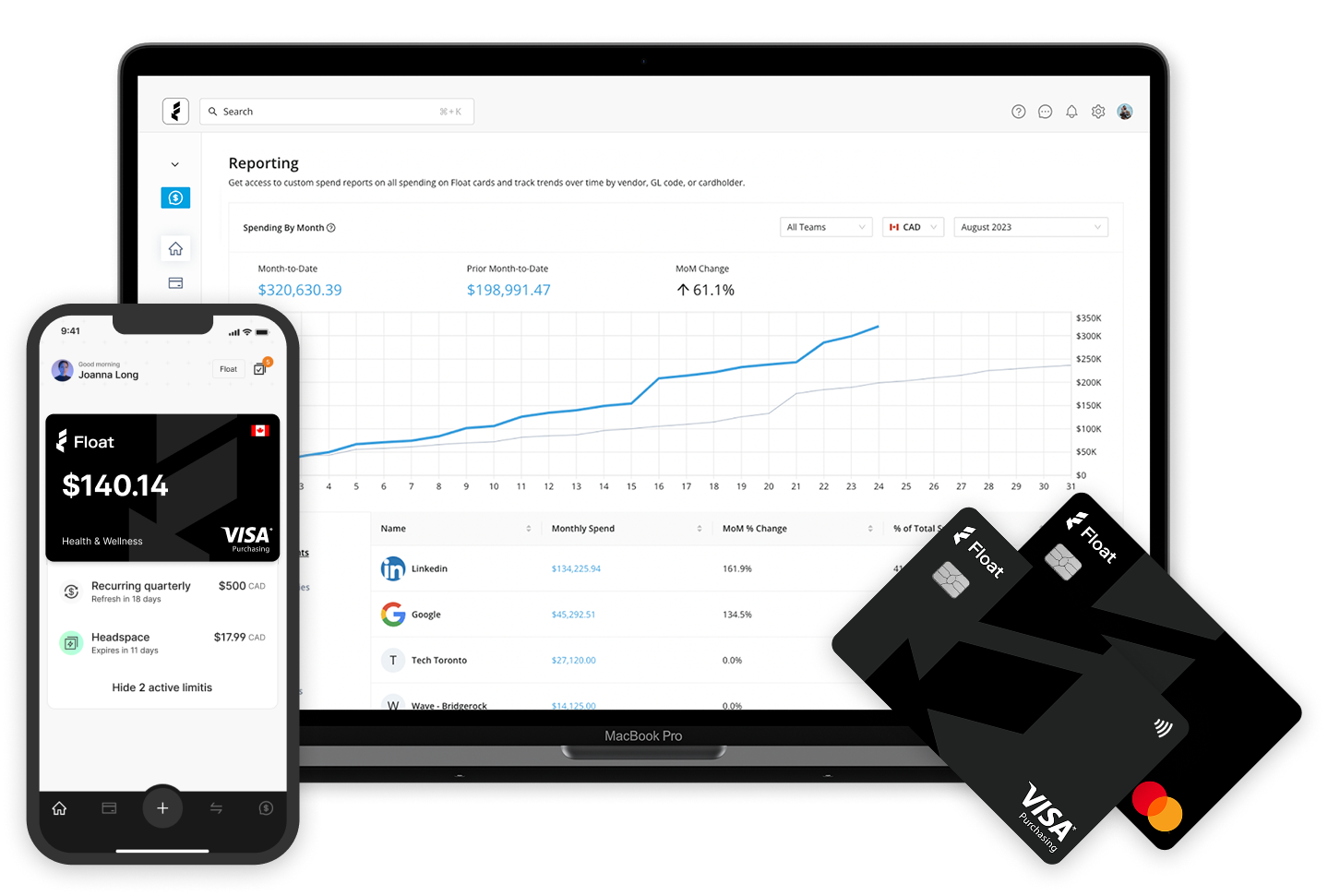

Corporate Cards

$1M card limits, 1 day approvals*, zero personal guarantees.

Canada’s smartest corporate card issued instantly in CAD and USD.

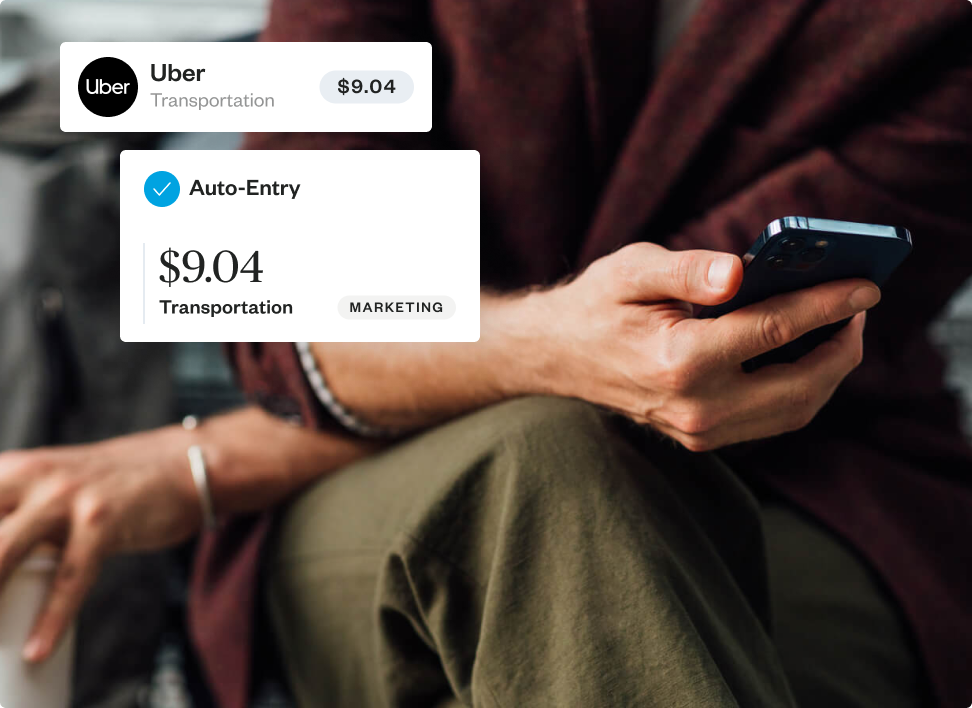

Expense Management

Close your books in hours not days.

Approve, manage and code your team’s spending with no manual entry.

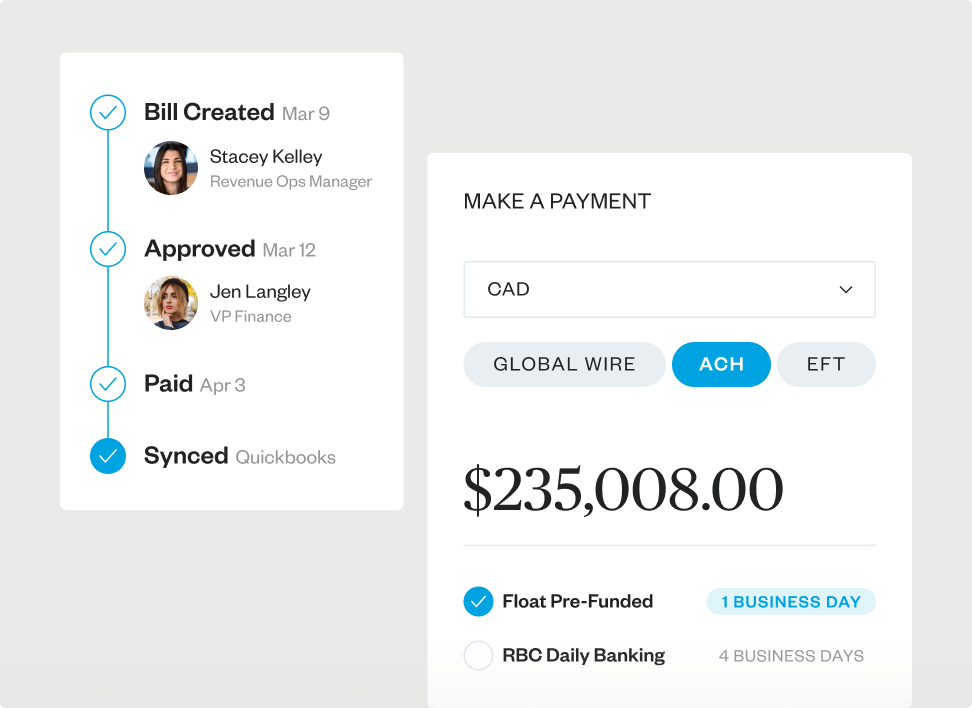

Bill Pay

Your entire accounts payable process, automated.

Import, approve and pay bills quickly—all from one place.

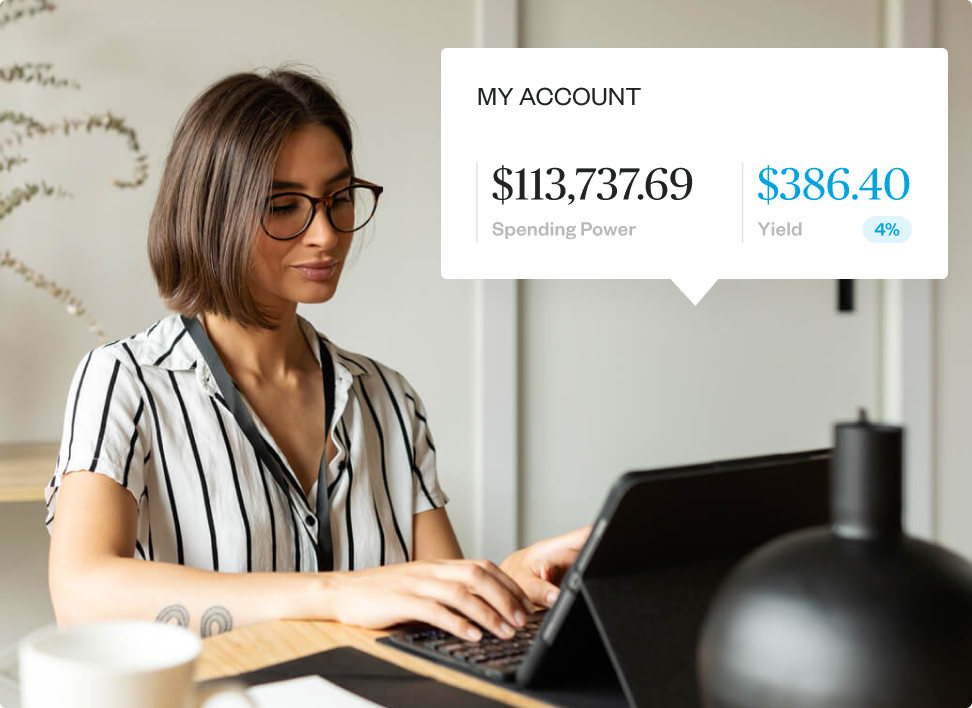

Business Accounts

Earn up to 4% interest automatically.

No lockups, no GICs, no hassles.

Built for Canada

Simplified spending for Canadian companies

CAD and USD cards, rewards and payments backed by CRA-ready software.

See How Our Platform Works

Float is how modern companies automate their spending while retaining control, so you can focus on what matters.

Save 7% on your

Spend with Float

With Float businesses can earn 1% cashback on card spend, up to 4% interest on funds held in Float, and close the books up to 8x faster.

Most things in

finance aren’t fast.

Our customer support is.

Our team is ready to help.

Fast, friendly support is just a click away.

Available when you need us.

“Float gives us great control over our finances. We’re able to monitor company spending and easily approve purchase requests. Float even reminds employees to submit their receipts on time.”

Adrian Pape

VP Finance

Float’s all-in-one solution replaces

Businesses have evolved.

Banks haven’t.

Fast-growing businesses need more flexibility and cashflow than banks can offer. With Float, get the spend you need when you need it, with smart corporate cards, time-saving software, and no hidden charges.

| Annual card fees | $120+ | $0 |

| Application time | 2-3 Weeks | 5 minutes |

| High limit, unsecured credit available1 | ||

| Create virtual cards instantly2 | ||

| Individual card controls | ||

| Automated receipt capture and matching | ||

| Accounting software sync | ||

| Real-time spend insights |

1 Conditions apply. Book a demo with our team for more details.

2 See details in our Terms of Service.

Get the goods with relevant business insights

It’s only required reading if you’re looking to level up your business knowledge. Check out our assortment of financial tidbits and case studies to see how Float can make things easier for your business.

Corporate Cards

Discover: Virtual Credit Cards for Canadian Businesses

Explore the benefits of virtual credit cards with Float. Discover how this modern payment solution enhances security and simplifies your

Read More

Cash Flow Optimization

ACH vs EFT Payments: Key Differences for Canadian Companies

Learn the key differences between EFT and ACH payments, how they work, which options might be available to your business

Read More

Corporate Cards

Xero Integration for Corporate Cards: Modern Accounting Software Guide

Using Xero becomes more powerful the second you integrate it with your corporate cards. Here’s what you need to know.

Read MoreSpend time and money where it counts.

Earn up to 4% interest on your cash balance and simplify business spend with corporate cards and expense management software.

*Trademark of Visa International Service Association and used under licence by Peoples Trust Company.