Float News

Float 2025: Year in Review

How Float is building the financial system Canadian businesses run on

February 17, 2026

When we started Float, Ruslan, Griffin and I weren’t trying to build another financial product.

We were trying to fix something more fundamental: the gap between how Canadian businesses actually operate and the financial tools they’re expected to use.

Most businesses still manage money across a fragmented stack: personal cards mixed with business spend, multiple disconnected accounts at different institutions, cheques and EFTs alongside modern software, delayed visibility, rigid credit and manual workflows. These aren’t edge cases. They’re the default.

Float exists to change that.

We’re building a financial system that gives Canadian businesses control, flexibility and clarity as they grow, without forcing them to work around outdated processes or institutions.

In 2025, Float crossed an important threshold. We stopped being a product companies tried, and became the infrastructure they run on.

Trust is the foundation

Float is in the business of trust. From the beginning, we knew that meant building differently than others in our space.

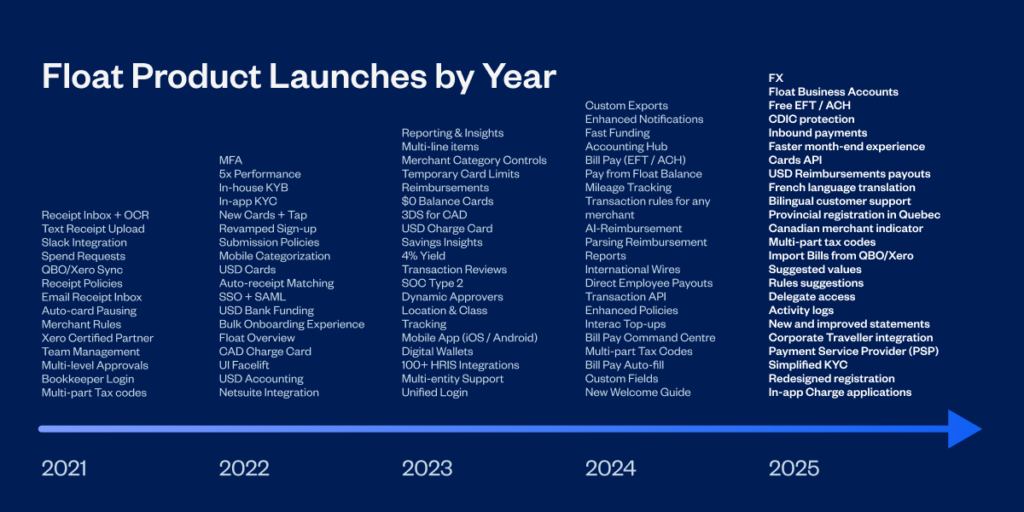

Over the last 60 months, we’ve built, shipped and iterated relentlessly not just for our customers but with them. And we haven’t cut corners. When businesses trust you with their money, there’s no room for shortcuts.

Which is why we’ve invested heavily in building world-class risk, compliance and fraud capabilities in-house, tailored to the realities of the Canadian market. Over time, nearly every layer of our stack has been built or brought in-house so we could meet higher standards of reliability and control.

When we started Float, activating an account could take weeks due to Know Your Business (KYB), Know Your Customer (KYC), and Anti-Money Laundering (AML) requirements. Accessing a credit limit could take even longer.

Today, most customers activate in under 24 hours, with automated processes that allow them not only to start spending and operating quickly, but also to access up to $100K in credit in less than a day, without compromising safety or compliance.

Float is built on a strong regulatory foundation that expanded in 2025 to include RPAA compliance, customer trust accounts, and CDIC insurance. This reliability enables businesses to confidently entrust Float with more of their financial operations.

Float at scale

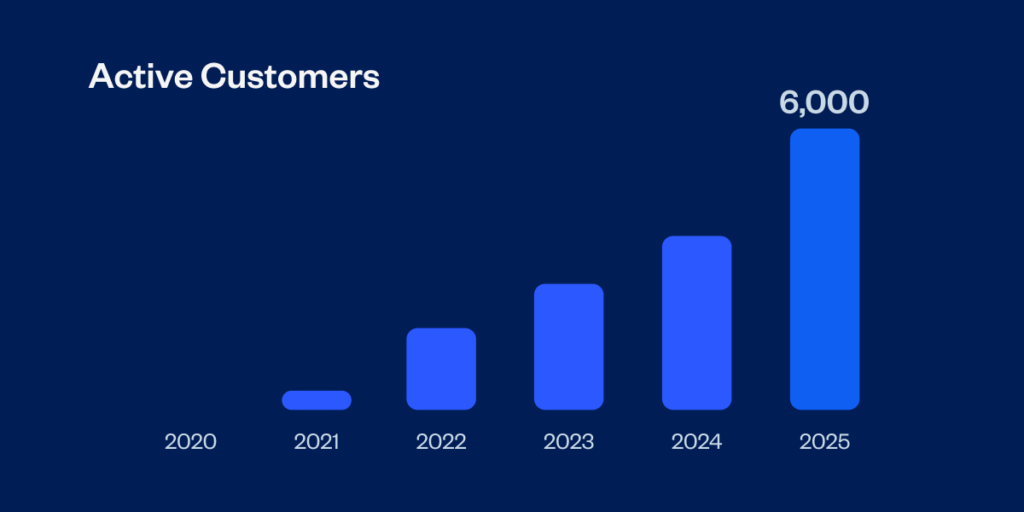

Today, more than 6,000 Canadian businesses and hundreds of thousands of users rely on Float, from one-person operations to companies with nearly 2,000 employees.

Float is used by many of Canada’s fastest-growing startups. Increasingly, it’s also used by businesses that simply want a better way to operate. While we started in tech, we now serve 20+ industries, with construction, healthcare, hospitality, non-profits and manufacturing among our fastest-growing.

Modern financial infrastructure isn’t only for companies that look like typical disruptors. It’s universal.

High tech, high touch

As Float has grown, we’ve refused to compromise on customer service.

From the beginning, our commitment was clear: customers will not wait weeks or days to hear back from us. When money is involved, responsiveness isn’t a luxury; it’s a requirement.

Today, we maintain a CSAT of >95%, with median response times of <15 minutes during business hours.

“The level of support from the Float team is unmatched,” says Suvansh Mehta, Strategy and Finance Manager at PolicyMe. “It’s been the best part about working with their team.”

Float’s numbers at a glance

Float ended 2025 processing $3B in annualized payment volume, up from zero in mid-2021.

More importantly, we added more customers in 2025 than in the previous two years combined. That growth is accelerating. In the final three months of 2025, we added nearly 40% more customers than in Q3-25.

What mattered most was not just growth, but how customers grew with us.

From product to platform

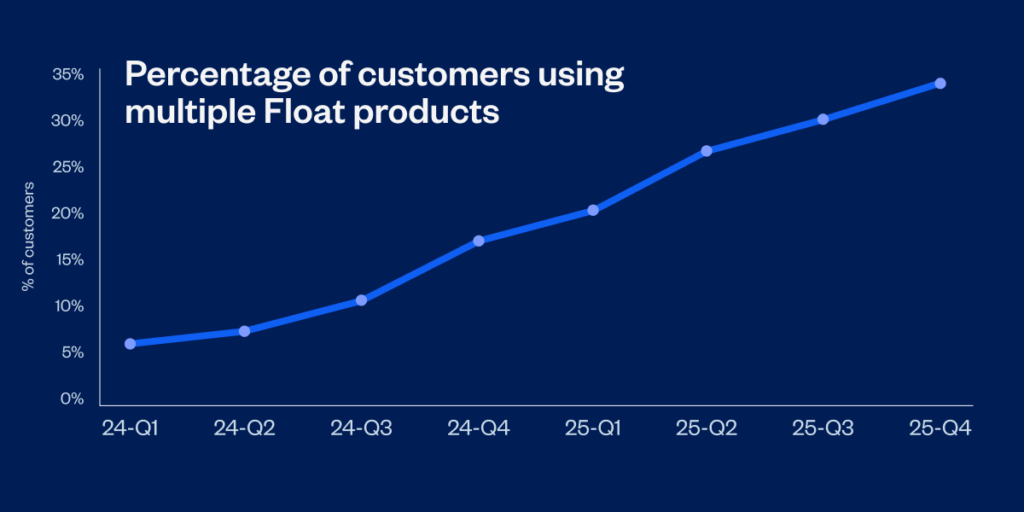

At the start of 2026, I told our team that 2025 was the year Float truly became a multi-product platform.

Over the past 18 months, Float launched new offerings across bill payments, business accounts, personal reimbursements, FX and our API.

In 2025, we saw the full impact of those launches.

Five products grew at 100% or more year over year, and multi-product adoption increased from 0% to 30% in just 18 months. Customers increasingly rely on Float not just for cards, but for a growing share of their business payments and banking workflows.

“When I saw we could have it all go to Float and get 4% interest and save so much on the FX, it was a super no-brainer,” says Nathan Murdoch, Co-founder of Toonie Tours, a Vancouver-based company that uses Float for cards, business accounts and FX. “We’re cutting fees where we can and we’re also earning while our money is just sitting there. It’s like the quote: have your money work for you.”

As Float becomes more central to day-to-day operations, usage compounds naturally. Multi-product customers are now our most engaged and fastest-growing cohort.

What’s ahead

When Float started, the market wasn’t fully ready. We had to build core financial services infrastructure from scratch, prove that fintech could be a real alternative to traditional banks and start with a single product and gradually build towards a unified platform. The first five years of Float were defined by foundational work: proving reliability, building regulatory-grade infrastructure and demonstrating that modern, software-led finance could even exist in Canada.

That context has now fundamentally changed. Trust is no longer the bottleneck. The platform is no longer singular. The infrastructure is in place.

We’re also seeing a convergence of accelerants in the market right now. Owner-operators and finance teams are increasingly ready to adopt modern finance tools. AI has raised expectations for automation and efficiency, but teams can’t leverage it on top of fragmented, legacy financial stacks. To benefit from automation, finance teams first need to centralize workflows, standardize data and upgrade the core systems where money actually moves.

Float’s foundation plus these market and technology shifts with AI have brought us to an inflection point. The next five years will look structurally different from the first five. Float now combines three forces that reinforce each other:

- A mature, multi-product platform that can be adopted day one

- The ability to build and ship faster on top of shared infrastructure

- A Canadian market that is actively looking for integrated finance solutions built specifically for them

We believe 2026 is the moment where those forces start to compound, accelerating both how we build and how customers adopt.

And we are still in the earliest stages of our ambition.

Our goal is simple: When a Canadian business moves money, Float should be the system it runs on.

We’re continuing to invest aggressively in product, engineering and design. We recently raised nearly C$100M to fuel the next phase of our credit platform, enabling over $1.5B in annual spending power for our customers.

Canadian businesses are ready for better financial infrastructure. Not more tools. Not more complexity. Systems that work.

We’re building Float for the long term, and we’re just getting started.

Rob,

Co-Founder & CEO

Float Financial

Written by

All the resources

Industry Insights

Canada’s Crossroads: Why Now is the Moment to Move from Defensive to Intentional Growth

Float's 2025 report on Canadian business shows modest growth, rising costs and shrinking reserves. Find out exactly what the data

Read More

Expense Management

Controller Month-End Close Automation: Streamline Financial Reporting

Controllers, this one's for you. Let's talk about how how automating month-end close helps you move faster without sacrificing accuracy.

Read More

Corporate Cards

Corporate Card Program Implementation: Complete Management Guide

Ready to implement a corporate card program? This is where to start.

Read More