Finance Team Efficiency

Best Accounting Software for Canadian Businesses: 2026 Complete Guide

Discover the best accounting software solutions for Canadian businesses. Compare top solutions like Quickbooks, Xero, FreshBooks, Sage 50, and Wave.

December 19, 2025

Running a Canadian small business? You need the right tools to stay sharp and in the know. Keeping tabs on your finances can be a real headache, especially if you’re a small business owner wearing all the hats. We’ve spent years putting accounting software through its paces, and weAccounting software has come a long way, and in 2026, Canadian business owners have more powerful options than ever before. The right platform can streamline your bookkeeping, automate tax filings and integrate seamlessly with the rest of your financial stack. Because let’s face it… nobody starts a business for the love of reconciling receipts.

We’ve put today’s top accounting platforms to the test and rounded up our list of the best accounting software for Canadian businesses in 2026. Each option is evaluated for user-friendliness, features, integrations and value for money, so you can find the perfect fit for your business size and goals.

Two clear standouts top our list:

- QuickBooks Online, for small to medium-sized teams

- FreshBooks, for freelancers and solo entrepreneurs

Ready to find the right fit for your business? Let’s dive into the top accounting tools in Canada for 2026 and how to choose one that makes bookkeeping simple, compliant and stress-free.

Top Picks for Canadian Small Businesses

Top accounting platforms for Canadian small businesses

| Solution | Best for | Price | Why Choose It |

| QuickBooks Online | Overall best solution for SMBs | $28–$190/month | – Scales easily as your business grows – Robust integrations – Excellent Canadian tax and compliance support – Strong mobile and reporting tools |

| Xero | Best for multi-user businesses | $25–$75/month | – Clean, intuitive interface – Excellent collaboration tools and permissions – Canadian bank connections – Expanding automation and AI-assisted reporting |

| FreshBooks | Best for freelancers and micro-businesses | $22–$60/month | – Simple, intuitive design for non-accountants – Built-in time tracking and project management – Great mobile experience – Perfect for service-based businesses and freelancers |

| Wave | Best free option for invoicing | $0-$25/month | – Free invoicing, accounting and receipt scanning – Built-in payments and pay-per-use payroll – Ideal for sole proprietors and startups – Canadian tax and multi-currency support |

| Sage 50 | Best for inventory-heavy businesses | $74–$545/month | – Powerful inventory and job costing tools – In-depth reporting and analytics – Built-in Canadian payroll and tax compliance – Desktop software with optional cloud access |

2026 updates to the Canadian accounting software market

The accounting software landscape in Canada continues to evolve quickly. In 2026, most leading tools—QuickBooks, Xero and FreshBooks included—are leaning heavily into automation and AI. Not surprisingly, 46% of accountants use AI daily in 2026, and 95% say technology reduces compliance time. From automated expense categorization to predictive cash flow reporting, these updates mean fewer manual tasks and faster month-end closes for small business owners.

Cloud-first (if not cloud only) has become the norm. Businesses expect real-time collaboration with bookkeepers and accountants, automatic data syncs and mobile access that keeps them connected anywhere. Many Canadian banks have deepened integrations as open banking moves closer to reality, making transactions faster and more accurate.

Security and compliance are also front of mind. With the CRA’s online filing requirements tightening and more sensitive data moving online, encryption, two-factor authentication and secure cloud hosting are becoming standard features across platforms.

Finally, rising operating costs have Canadian business owners looking for more ways to save, so many accounting platform pricing models (especially in the software-as-a-service, or “SaaS,” realm) are shifting toward greater flexibility. Many providers are offering modular or usage-based plans, allowing Canadian businesses to pay only for the features they use.

In short: to stay ahead, pick an accounting software that not only handles basic bookkeeping, but that supports automation, integrates across your financial stack and grows with your business. Let’s see how each solution stacks up.

How to choose accounting software for growing businesses

As your business grows, the way you manage your books should grow with you. Here’s what to look for when you’re ready to upgrade from “just getting by” to fully dialed in.

Scalability and growth potential

When your business is small, it’s easy to get by with simple invoicing tools or spreadsheets. But as revenue, transactions and headcount increase, your software needs to keep pace. Look for a platform that can grow with you, offering advanced reporting, payroll or multi-entity management when you need it. Switching systems mid-growth can be painful (and expensive), so think ahead now to save time later.

Automation that actually saves time

The best accounting tools take the busywork off your plate. Accounting automations like synced bank feeds, expense categorization and AI-powered cash-flow insights mean fewer manual entries and fewer errors. If you find yourself reconciling the same transactions every month or chasing down receipts, your software isn’t working hard enough for you.

Integrations that make your stack stronger

Your accounting software shouldn’t live in a silo. It should connect seamlessly with the tools you already use—your bank, payroll provider, CRM and especially your corporate cards or spend management platform. When these systems talk to each other, transactions flow automatically, reports stay up to date and your month-end close takes hours instead of days.

Ease of use and collaboration

Even the most advanced system isn’t useful if no one wants to use it. Prioritize an intuitive interface that your team (and your accountant) can navigate without a manual. Cloud-based access, clear permissions and mobile apps make it easy for everyone to work from anywhere and keep financial data current.

Cost that matches value

Sticker price doesn’t tell the whole story. Some plans look affordable until you add payroll, extra users or reporting tools. Others cost more upfront but deliver major time savings through automation. Think of it like hiring an extra team member: the right software should pay for itself in efficiency and accuracy.

Support and compliance you can rely on

Tax rules change, integrations break and software updates happen. Choose a provider that keeps up with CRA requirements, offers responsive support and provides resources for onboarding or troubleshooting.

Other factors to consider

We think some decision factors deserve a deeper dive—because where your data lives, how secure it is and how well it plays with your financial stack can make or break your day-to-day workflow.

Cloud vs desktop accounting software in 2026

It used to be that accounting lived on a single computer in one office. Those days are long gone. In 2026, cloud-based platforms have become the standard for good reason: they’re faster, more flexible and easier to keep secure. You can log in from anywhere, your accountant can make updates in real time and data syncs automatically across your devices.

That said, desktop systems like Sage 50 still have their place. If your business manages large data sets, complex inventory or needs offline access (say, in areas with unreliable internet), desktop software can offer performance and control that cloud tools sometimes can’t match.

For most Canadian businesses, though, the cloud wins on collaboration, automation and peace of mind. Updates happen automatically, backups are handled for you and you’re not tied to a single hard drive.

Accounting software security for Canadian businesses

When your accounting software holds everything from payroll to tax filings, you don’t want to take shortcuts on security. Thankfully, most modern platforms have learned that lesson. Encryption, two-factor authentication and automatic backups are now must-haves.

For Canadian businesses, there’s one extra wrinkle: where your data actually lives. Depending on the sensitivity of your data, you may want to check whether your accounting software stores data in Canada (AKA meets Canadian data residency requirements) or meets local privacy laws like PIPEDA.

And let’s not forget about the “people” side of security. The riskiest click in your business is usually a human one. Pick software that lets you manage access levels, track activity and set approval rules so nothing slips through the cracks.

Accounting software integration with corporate cards

The real power of accounting software shows up when it connects seamlessly with the rest of your financial tools—especially your corporate cards and spend management platform. Instead of juggling receipts, expense reports and spreadsheets, integrated systems let every transaction flow straight into your books, already categorized and ready to reconcile. Purchases made on company cards sync automatically, so you can see spending in real time, keep budgets on track and close your books faster.

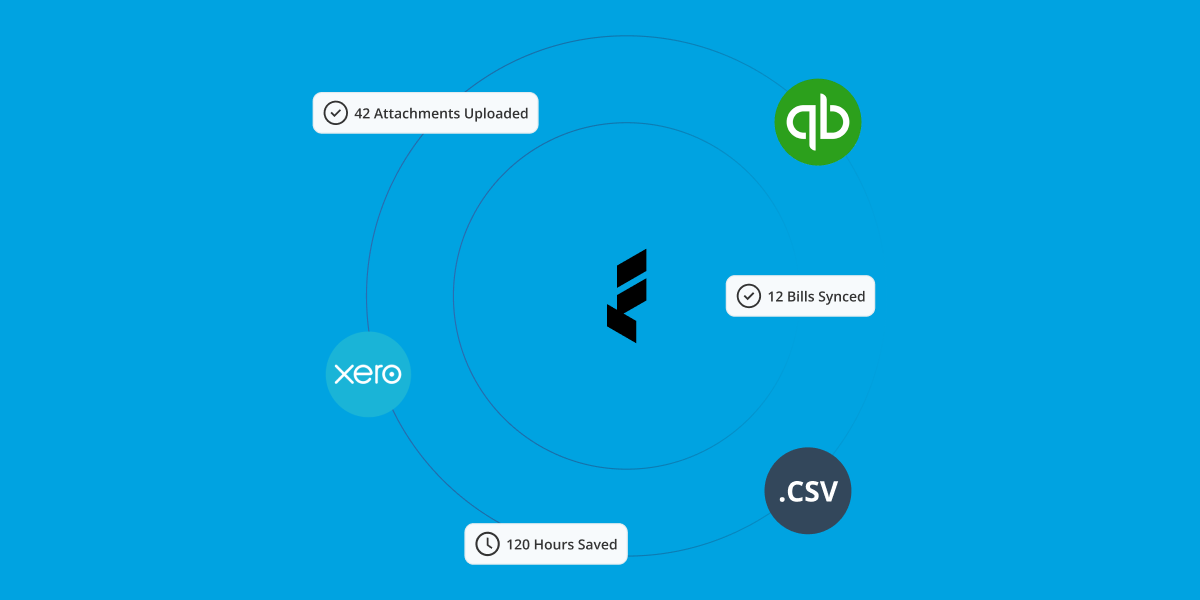

This is exactly what Float was built for. Float’s corporate cards, reimbursements and bill pay tools integrate directly with accounting platforms like QuickBooks Online and Xero, automating accounting and syncing transactions instantly. No more chasing receipts or mystery line items. Just clean, up-to-date books that practically balance themselves.

Our review of the best accounting software for Canadian businesses

Now that you know what to look for, it’s time to consider who to look at for those features. Let’s dive in.

QuickBooks Online

QuickBooks Online remains one of the most popular accounting platforms for Canadian small and medium-sized businesses, and for good reason. It’s cloud-based, scalable and packed with features designed to simplify bookkeeping, payroll and compliance in one platform.

Key features

- Invoicing: Create branded invoices and automatically track payments.

- Expense tracking: Capture receipts via mobile app and categorize expenses with AI-powered accuracy.

- Bank connections: Sync with major Canadian banks for real-time transaction updates.

- Canadian tax support: Calculate GST/HST automatically and prepare returns.

- Payroll integration: Add payroll and benefits management for your team (optional add-on).

- Reporting: Access detailed financial and cash-flow reports for better decision-making.

- Multi-user access: Collaborate securely with your accountant or bookkeeper in real time.

- Mobile app: Manage your finances from anywhere on iOS or Android.

- AI-powered insights (new as of 2025): Smart categorization and predictive cash-flow tools powered by machine learning.

Who it’s best for

QuickBooks Online is ideal for:

- Small to medium-sized businesses

- Service-based companies and retailers

- Businesses that need payroll, inventory or project tracking

- Teams seeking a scalable, cloud-based solution

Its depth, automation and long-standing reputation make it one of the most trusted all-in-one accounting tools in Canada.

Canadian-specific features

- Built-in GST/HST tracking and CRA-compliant tax reports

- Integration with major Canadian banks and credit unions

- Support for multi-currency transactions in CAD and USD

- Optional bilingual invoices for Québec-based businesses

Price: $28–$190/month

Xero

Xero continues to gain traction among Canadian small businesses for its intuitive design and powerful automation tools. It’s a cloud-based platform built for collaboration, making it easy for teams and accountants to stay aligned no matter where they’re working from.

Key features

- Bank reconciliation: Automatically import and categorize bank transactions.

- Invoicing: Create professional invoices and offer online payment options.

- Expense management: Track and manage business expenses with ease.

- Inventory tracking: Monitor stock levels and costs in real time.

- Project tracking: Keep an eye on time and budgets for client work.

- Payroll: Integrates with third-party providers like Wagepoint for Canadian payroll.

- Multi-currency support: Handle international transactions across 160+ currencies.

- Reporting: Generate customizable financial reports and insights.

- AI-assisted automation (new as of 2025): Enhanced smart coding, reconciliation and forecasting tools.

Who it’s best for

Xero is ideal for:

- Small to medium-sized businesses

- Teams that need multi-user collaboration

- Companies with international clients or suppliers

- Businesses seeking simple automation and real-time data

Its clean interface and deep integration capabilities make it a strong option for businesses looking for a modern, scalable accounting solution.

Canadian-specific features

- GST/HST tracking and automated tax reporting

- Integration with major Canadian banks

- Compliance with Canadian accounting standards

- Bilingual invoicing options

Price: $25–$75/month

FreshBooks

FreshBooks remains a favourite among Canadian freelancers, consultants and service-based small businesses. It’s designed for simplicity, offering a modern interface, strong mobile functionality and features that make invoicing and expense tracking feel effortless.

Key features

- Invoicing: Create professional, customizable invoices with automatic reminders.

- Expense tracking: Capture and categorize expenses with built-in receipt scanning.

- Time tracking: Track billable hours and convert them directly into invoices.

- Project management: Collaborate with clients and teammates on shared projects.

- Client portal: Give clients a secure space to review and pay invoices online.

- Reporting: Access key financial reports like profit and loss or tax summaries.

- Double-entry accounting: Ensures accuracy for accrual accounting.

- Bank connections: Sync with Canadian bank accounts for real-time expense data.

- Mobile app: Manage billing, expenses and time tracking on the go.

Who it’s best for

FreshBooks is ideal for:

- Freelancers, consultants and creative professionals

- Small service-based businesses

- Agencies and contractors who bill hourly

- Entrepreneurs who want simplicity without sacrificing professionalism

Its user-friendly design and automation tools make it a great choice for anyone managing clients and cash flow without a dedicated finance team.

Canadian-specific features

- GST/HST tracking and CRA-compliant reporting

- Integration with Canadian banks and payment gateways

- Support for CAD and USD transactions

- Bilingual invoice options for Québec-based businesses

Price: $22–$60/month

Wave

Wave continues to stand out as one of the best free accounting tools for Canadian small businesses, freelancers and startups. It offers a strong core suite of accounting, invoicing and receipt-tracking features, without the monthly cost. For entrepreneurs just starting out, it’s an accessible, easy-to-learn option.

Key features

- Accounting: Double-entry bookkeeping system with automated transaction syncing.

- Invoicing: Create and send professional invoices with built-in payment options.

- Receipt scanning: Capture and organize receipts using the mobile app.

- Bank connections: Link Canadian bank accounts and credit cards for real-time updates.

- Financial reporting: Generate income statements, balance sheets and cash-flow reports.

- Multi-currency support: Handle payments in CAD, USD and other currencies.

- Collaborator access: Invite your accountant or team for secure collaboration.

- Optional add-ons: Pay-per-use payroll and payment processing services.

Who it’s best for

Wave is ideal for:

- Freelancers and sole proprietors

- Startups and side businesses with simple accounting needs

- Entrepreneurs seeking a free, cloud-based option

- Teams looking to minimize overhead while staying organized

While Wave may not include advanced features like inventory management or job costing, it covers the essentials exceptionally well and scales through optional paid tools.

Canadian-specific features

- GST/HST tracking and tax reporting

- Integration with major Canadian banks

- Multi-currency and bilingual support

- Optional Canadian payroll service

Price: $0–$25/month

Sage 50

Sage 50 (formerly Simply Accounting) remains a trusted choice for established Canadian businesses that need powerful, detailed accounting capabilities, particularly for managing inventory, job costing and payroll. While it’s desktop-based, Sage 50cloud (their cloud product) brings remote access and hybrid functionality for teams that want both performance and flexibility.

Key features

- General ledger: Manage comprehensive financial records with audit-ready accuracy.

- Accounts payable and receivable: Track bills, payments and customer invoices.

- Inventory management: Monitor stock levels, costs and reorder points.

- Job costing: Allocate expenses and measure profitability by project.

- Payroll: Built-in Canadian payroll with automatic tax calculations and remittances.

- Bank reconciliation: Match transactions efficiently against your bank feeds.

- Reporting and analytics: Generate advanced financial and management reports.

- Fixed asset management: Track depreciation and asset value.

- Cloud access: Sage 50cloud offers secure online storage and remote collaboration.

Who it’s best for

Sage 50 is ideal for:

- Established small and mid-sized businesses

- Companies with complex accounting or inventory needs

- Manufacturers, wholesalers or retailers managing large product catalogs

- Businesses requiring detailed reporting and audit trails

It’s a powerful, feature-rich platform for businesses that have outgrown simpler accounting software and need deeper control and customization.

Canadian-specific features

- Built-in Canadian payroll and tax calculations

- GST/HST tracking and reporting

- Compliance with Canadian accounting standards

- Bilingual interface and reporting options

Price: $74–$545/month

Tips for getting started

If you still can’t decide on the right accounting software, start by asking your bookkeeper for professional advice. Don’t have a bookkeeper? Check out our guide on how to find the right financial partner for your business.

If you’re choosing software on your own, keep these criteria in mind:

- Take advantage of free trials to see which system fits your workflow.

- Check for Canadian features like GST/HST tracking and CRA integrations.

- Read reviews from other Canadian business owners.

- Make sure the software can grow with you.

And remember: the best accounting software for your business is the one you’ll actually use. Don’t get distracted by bells and whistles you’ll never touch.

Take control of your spend with Float

Accounting software is the foundation of good financial management, but it’s only one part of the picture. Tools that help you manage spending, automate reimbursements and pay bills faster can take your operations to the next level.

That’s where Float fits in.

Float is Canada’s only all-in-one platform for corporate cards, reimbursements and bill payments, built to work seamlessly alongside your accounting software. Transactions sync automatically to tools like QuickBooks Online and Xero, receipts are collected in real time and your team’s spending stays transparent from start to finish.

With Float, Canadian businesses can:

- Eliminate manual expense reports and receipt chasing

- Sync transactions automatically to their accounting platform

- Earn cashback and interest on funds held with Float

- Close the books up to 8× faster each month

- Generate 4% interest on funds held in Float’s High-Yield Accounts

Want to learn how companies like Clutch, Neo, Knix and 1,000s of other Canadian businesses on average save 7% of their monthly spend with Float? Get started with Float today!

Your questions, answered

Is there truly free accounting software for Canadian businesses?

Yes. Wave offers a free plan that covers the basics like accounting, invoicing and receipt tracking. It’s a solid option for freelancers or very small teams that want simple functionality without the monthly cost.

Do I need special accounting software if I’m a freelancer?

Not necessarily. Platforms like FreshBooks or Wave are built for service-based entrepreneurs and small teams that you can take advantage of as a freelancer. They cover what you need—professional invoicing, expense tracking and GST/HST reporting—without extra complexity.

Can I switch accounting software mid-year?

You can, but it’s best to do it at the start of a fiscal year or quarter. That way, your opening balances and reporting periods line up cleanly.

How often should I update my books?

At least once a month. But the more often you do it, the easier it is to catch errors, stay compliant and keep cash flow predictable.

Written by

All the resources

Cash Flow Optimization

ACH vs EFT Payments: Key Differences for Canadian Companies

Learn the key differences between EFT and ACH payments, how they work, which options might be available to your business

Read More

Corporate Cards

Xero Integration for Corporate Cards: Modern Accounting Software Guide

Using Xero becomes more powerful the second you integrate it with your corporate cards. Here's what you need to know.

Read More

Float News

Float 2025: Year in Review

How Float is building the financial system Canadian businesses run on

Read More